The evolution of the CFO as a strategic visionary and business advisor

PART ONE – CHALLENGES FACING CFOS

CFOs have been gradually transitioning to a more influential and business-focused role, presenting them with a different range of challenges and a complex and demanding remit.

KEY TAKEAWAYS:

KEY TAKEAWAYS:

- The role of CFOs has been evolving for 15 years, though the COVID-19 pandemic has accelerated the trend and further elevated their position as a key business partner to the CEO, creating an overall more challenging and demanding job.

- Rather than replacing the traits required of a successful CFO, this evolution has widened what CEOs and boards look for – combining both legacy finance skills, which are almost a given nowadays, with strong commercial and operational understanding.

- The leadership DNA of a CFO is therefore also changing, with the best CFOs now able to offer strategic vision to the CEO while showing adaptability, fuelling agility in the wider business, and inspiring and motivating people in a more virtual world.

- Succession routes will be split fairly equally between internal and external hires, depending on the contextual perception of the business at the time, and a diverse range of candidates is likely to be more important than hiring from the same industry.

The CFO has evolved significantly over the last ten to 15 years. The 2008 global financial crisis was a particular inflexion point, whereby the crucial part CFOs played in steering companies through choppy waters and back to growth reflected not just their growing influence but also their broadening remit. The CFO has since emerged as the corporate conscience and the most prominent business partner, and indeed sounding board, to the CEO. By the time the latest major crisis arrived in February 2020 in the form of the COVID-19 pandemic, it was clear that many CFOs had become a leading strategic force within organisations.

Having more influence at the very top of a business, usually one of only two executive directors on the board, has no doubt given CFOs heightened exposure, but it has also made their job more complex and demanding. Still responsible for reporting, forecasting and the day-to-day running of the finance function, they are also expected to make more strategic contributions, and in many cases even serve as a de facto co-leader of the business. Boards continue to rely on CFOs for risk analysis, but they also want them to be able to view challenges and opportunities through a commercial as well as financial lens.

To ease the pressure on CFOs and free up some of their time typically dominated by reporting historic numbers and controlling risk and cost, it has become common to delegate some responsibilities down to their finance team. They are still expected to keep a forensic eye on the detail, however, while also overseeing other functions such as technology, legal and procurement, and leading groupwide transformation programmes.

From Legacy to Leader

In autumn 2020, Savannah Group surveyed CFOs from FTSE and PE-backed companies about their views on how the traits and skills required of a successful CFO are changing. The responses to an open question about their fundamental challenges in the next three to five years echoed the journey that many CFOs have been on from a legacy role, concentrating on financial control and process, to an essential business driver. It is telling that half of respondents described their role as either a deputy CEO or combined CFO and COO, a trend that will continue to grow.

Naturally, many of the responses emphasised more traditional finance responsibilities, albeit more challenging in a time of such unprecedented uncertainty. The CFO of a large care home provider, for example, identified forecasting post-COVID as particularly important for providing confidence to equity and debt investors, as well as developing cost structures to meet the new demands and deciding where businesses should invest.

The CFO of a FTSE manufacturer expressed a similar view, calling for “more timely analysis and forecasting of trends as a basis for rapid action and implementation amidst significant amounts of change and uncertainty”. The CFO of a soft drinks manufacturer said in an environment of “competing tensions”, when the business wants agility in the face of uncertainty, CFOs should stick to “championing controls and process”. They were echoed by the CFO of a listed pubs and restaurants group who said the biggest challenge is “implementing a long resilient capital structure and efficiency of costs”, while the CFO of a PE-backed training firm also noted the challenges surrounding “liquidity and forecasting given the uncertainty”.

Elevated Focus

Other responses, however, while still concerned with legacy finance challenges like cash flow, forecasting and capital structures, also clearly demonstrated the transition that many CFOs have made into a more elevated, business-centric and sometimes even customer-oriented role. The CFO of a listed industrial and electronic products distributor noted liquidity as a challenge, for example, but also mentioned changing work styles and digital customer interaction. And the CFO of a FTSE manufacturer acknowledged the importance of ensuring adequate cash resources but then also stressed the need to “capture permanently the value of the strategic shifts in consumer behaviour and industry dynamics while remaining agile to respond to rapid shifts”.

The CFO of a FTSE recruitment firm pointed to liquidity management while outlining wider strategic responsibilities: “The challenge is managing costs without killing the business, but also scenario planning to be prepared for a wide range of fast-moving outcomes, both positive developments and negative.” Meanwhile, the CFO of a FTSE defence company also listed cash as a key challenge next to strategic vision in an uncertain business landscape: “What does the new work look like? What has changed?”

Some responses, even, could easily have been written by a CEO, underscoring just how business focused CFOs are. One respondent said the biggest challenge facing him as CFO of a FTSE shipping company is achieving the right balance between progress and profit in a world where short-term returns are a focus of investors. “It’s not easy in the best of times, but it’s made far more difficult when there are so many possible changes to the business landscape,” he said. “Brexit, China, sustainability, the need for increased taxation; all must be balanced against an internal dynamic where staff are thinking of work-life balance and changes to their normal working practices.”

Balancing Act

The CFO of a large media and telecoms group also used the word balance when explaining his most pressing challenges. “We need to reinstate value-driving activities that were cut during the height of the pandemic and find more efficiencies due to the losses we have incurred whilst at the same time plotting a revised long-term path for growth,” he said, adding that CFOs should be a “guiding light” during uncertain times, “ensuring that we make measured, balanced choices that can be amended if necessary”.

Far from technical finance tasks, the challenges noted by some CFOs focused entirely on macro business factors. “Global recession, the outcome of Brexit, trade deals between the UK and other nations but also between the US and China,” listed the CFO of a standards body. And the CFO of a FTSE waste management firm said: “Macroeconomic growth, geopolitical deterioration from China to Brexit, climate change and energy transition.”

All of this has meant the skillset required of a successful CFO is evolving, quite rapidly, in line with their changing role and responsibilities. Future CFOs must now be an accomplished financial, operational and commercial leader while keeping numerous different plates spinning and being relied on by CEOs for their business and strategic judgement. In a year of momentous disruption, stakeholders in both listed and private equity environments have looked to the CFO for stability and confidence, not just in terms of liquidity and forecasting but as a true business leader supporting the CEO.

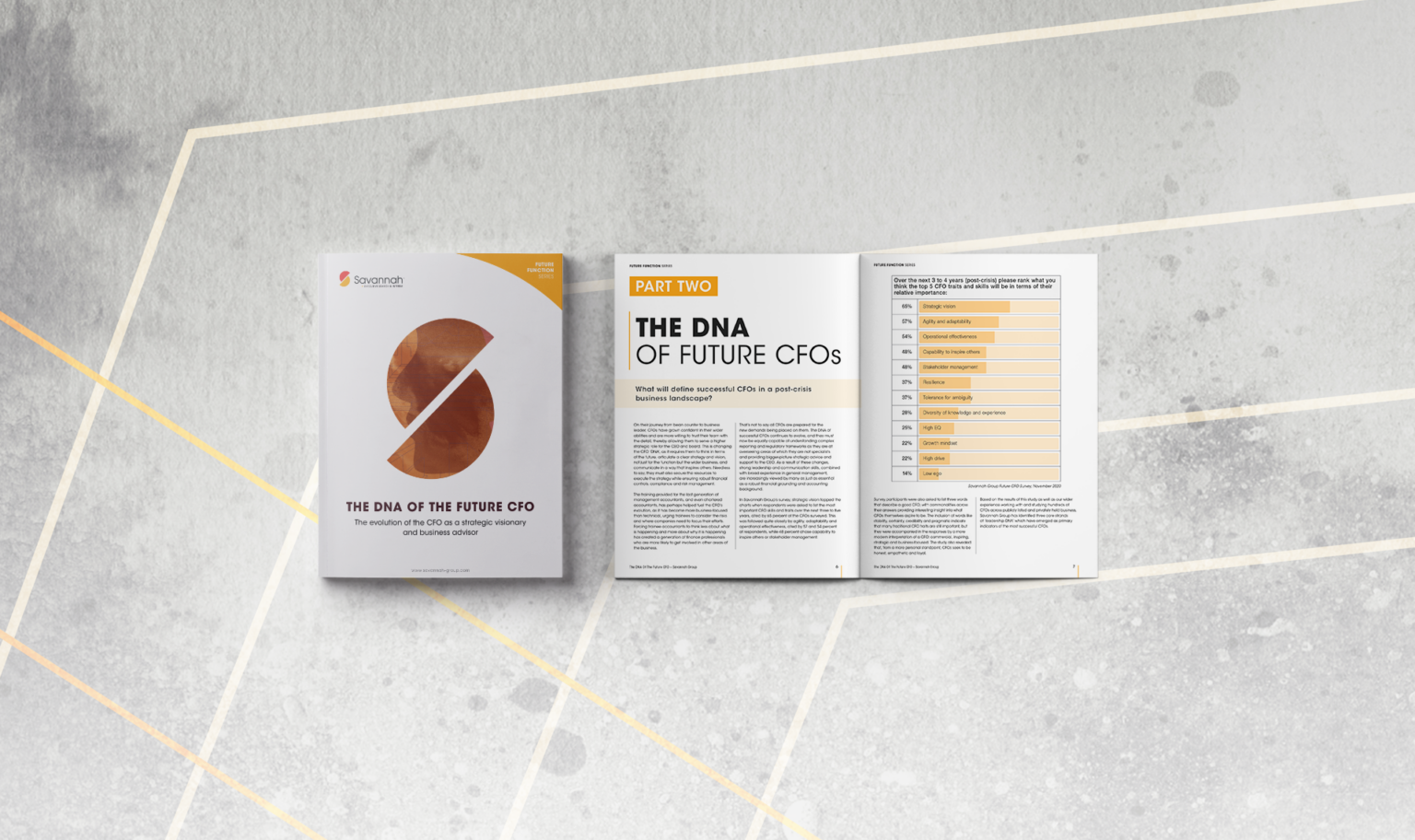

PART TWO – THE DNA OF FUTURE CFOS

What will define successful CFOs in a post-crisis business landscape?

On their journey from bean counter to business leader, CFOs have grown confident in their wider abilities and are more willing to trust their team with the detail, thereby allowing them to serve a higher strategic role for the CEO and board. This is changing the CFO ‘DNA’, as it requires them to think in terms of the future, articulate a clear strategy and vision, not just for the function but the wider business, and communicate in a way that inspires others. Needless to say, they must also secure the resources to execute the strategy while ensuring robust financial controls, compliance and risk management.

The training provided for the last generation of management accountants, and even chartered accountants, has perhaps helped fuel the CFO’s evolution, as it has become more business-focused than technical, urging trainees to consider the risks and where companies need to focus their efforts. Forcing trainee accountants to think less about what is happening and more about why it is happening has created a generation of finance professionals who are more likely to get involved in other areas of the business.

That’s not to say all CFOs are prepared for the new demands being placed on them. The DNA of successful CFOs continues to evolve, and they must now be equally capable of understanding complex reporting and regulatory frameworks as they are at overseeing areas of which they are not specialists and providing bigger-picture strategic advice and support to the CEO. As a result of these changes, strong leadership and communication skills, combined with broad experience in general management, are increasingly viewed by many as just as essential as a robust financial grounding and accounting background.

In Savannah Group’s survey, strategic vision topped the charts when respondents were asked to list the most important CFO skills and traits over the next three to five years, cited by 65 percent of the CFOs surveyed. This was followed quite closely by agility, adaptability and operational effectiveness, cited by 57 and 54 percent of respondents, while 48 percent chose capability to inspire others or stakeholder management.

Survey participants were also asked to list three words that describe a good CFO, with commonalities across their answers providing interesting insight into what CFOs themselves aspire to be. The inclusion of words like stability, certainty, credibility and pragmatic indicate that many traditional CFO traits are still important, but they were accompanied in the responses by a more modern interpretation of a CFO: commercial, inspiring, strategic and business-focused. The study also revealed that, from a more personal standpoint, CFOs seek to be honest, empathetic and loyal.

Based on the results of this study as well as our wider experience working with and studying hundreds of CFOs across publicly listed and privately held business, Savannah Group has identified three core strands of ‘leadership DNA’ which have emerged as primary indicators of the most successful CFOs.

Strategic Vision and Business Advisor

Having closely observed the CFO role for many years now, we were unsurprised to see that strategic vision was identified by survey respondents as the most important attribute in CFOs, particularly as businesses emerge from the pandemic crisis. Their transition from bean counter to business partner has very much been driven by the desires of CEOs, who ultimately want somebody to help them run the business.

It’s no secret that being CEO can be a lonely job. The buck stops with the CEO, and it always will. It is no surprise, then, that when asked what they think the CEO wants from a CFO, a ‘business partner’ and ‘sounding board’ were the emphatic responses by CFOs, cited by 85 percent and 74 percent of respondents respectively. One CFO surveyed spoke for many when he said CEOs want a CFO to be their “right hand; part partner, part COO and the right balance of loyal, challenging and sounding board”.

Most CEOs want to have somebody who, if all else fails, they can say is their successor. More often than not that confidence is placed in a CFO, and not just because that’s who the board sees most of after the CEO. Trust and understanding are at the heart of the relationship with the CEO and board, but CFOs also need the courage to ask challenging questions and deliver tough messages. They must be able to tell a story from the numbers (which involves understanding them in the first place), deliver strategic insights and understand the impact of decisions on the business as a whole. This much broader, business-focused DNA means CFOs are increasingly technically able rather than technically superb when it comes to hard finance skills.

Agility and Adaptability

It was perhaps inevitable that the second most important trait identified by CFOs was in fact the same as what a similar study by Savannah Group, identified as the number one trait in a future CEO: agility. Indeed, if CFOs are to be a close business partner to the chief executive, some of the skills that both require to be successful will overlap, and in an uncertain and rapidly changing business landscape it couldn’t be more vital that companies are able to pivot and adapt to the environment around them.

Remaining flexible will be challenging from a financial, strategic and operational standpoint, which is why CFOs that exhibit skills and strong judgement in all of these areas are more likely to thrive. Technology is also an essential driver of flexibility, so CFOs that digitally transform the finance function, and indeed ensure processes and systems throughout the whole organisation receive a healthy dose of automation, will be enriched with new data with which to inform better business decision-making. This will also naturally bring CFOs closer to crucial insights such as customer experience.

That’s not to say the core talents of CFOs won’t be required anymore. The ability to analyse and forecast accurately in uncertain times is a highly important skill of an experienced CFO, and as the basis for borrowing money it also enables businesses to adapt and pivot more quickly. Understanding what the capital structure needs to be in an uncertain landscape is also paramount. Does the business need to borrow more or less? Does it need to put some money away, or will the markets punish it for having a lot of cash and not doing much with it? CFOs able to answer these questions confidently, and execute with creativity, will provide businesses with their needed agility.

Inspiring People in a Virtual World

COVID-19 forced businesses to embrace flexible working and virtual platforms for both internal collaboration and external interactions with customers, partners and investors. Though the pandemic will eventually come to an end, workplaces will not return to what they used to be. Many businesses are already planning for a more hybrid future of work that combines a dispersed remote workforce with central collaboration hubs.

As CFOs take a more prominent leadership role in businesses, they will be expected to inspire and motivate people, and that means learning how to do so in a digital world. CEOs and boards are looking for CFOs with enormous energy, an ability to inspire geographically diverse and virtual teams, and who give confidence to all stakeholders.

Team leadership and development are crucial skills that CFOs must master, and doing so in a virtual environment might favour those who tend to be more introverted characters. The CEO can’t get around the whole business virtually, so CFOs will play a central role in building culture, team ethos and ensuring new workers are onboarded successfully. They will also need strong stakeholder management skills, whether that be engaging with investors or other department heads and functions across the business. The ability to inspire and motivate people is what will set future successful CFOs apart.

PART THREE – FUTURE CFO SUCCESSION

If the skills and traits required of a successful CFO are evolving, are the approaches to identifying the best succession candidates, internally and externally, changing too?

Other than the CEO and chair, the CFO appointment is the most important hire in any listed company. As an executive board hire, it is also a very visible appointment. This means the factors influencing the CFO search criteria and parameters, whether an internal or external successor, are different than any other hire in the business. With the CFO role also becoming more influential in its own right, external stakeholders and investors are even more likely to take a strong view on who is chosen.

In the Savannah Group study, CFOs valued internal and external succession candidates in almost equal measure, though internal candidates slightly edged it with 57 percent of respondents saying they are important or very important, compared to 51 percent for external candidates. However, for listed companies especially, boards are more likely to view CFO succession in a similar way as they do CEO succession, which is by assessing it contextually as per how investors and shareholders perceive the business at the time.

That means if a company has been perceived as being well-run, and is highly regarded in the City, an internal succession is more likely to be welcomed. If the City holds an opposite opinion, however, an external CFO who could be seen as able to help turn things around, or even challenge an under pressure CEO, may be preferred. Likewise, if a business is seen as needing to restructure and reduce costs, a board may seek an external candidate with experience of doing that elsewhere. If its strategy is to grow rapidly through M&A, and it lacks an internal head of M&A suitable for CFO, then that will drive the search.

Looking Outside the Industry

When external succession candidates are sought, the traditional preference of hiring from the same industry appears to have been somewhat diluted in recent years. Only 23 percent of the CFOs surveyed felt it was important or very important to have succession candidates with experience from within the same industry. This compares, interestingly, to 37 percent who said it’s important to have candidates from outside of the industry. We interpret this view as meaning an adjacent ‘outside’ industry, such as a manufacturing firm hiring a CFO from an FMCG business, or going from a SaaS to a fintech company, as opposed to recruiting, for example, a healthcare CFO for a bank.

This widening of the talent pool when it comes to targeted industries is likely to reflect the narrowing of desirable candidates that has resulted from the CFO’s transition to a commercial and operational leader rather than just financial leader. With fewer candidates equally strong across all three areas, and possessing the skills to inspire people, businesses may need to look further afield. Size is also an important factor. It’s difficult for any external candidate to become CFO at a billionpound business if they haven’t held the same role at a similarly sized or at least very significant entity. A CFO’s number two in a billion-pound business is more likely to become the CFO of a £200 million company.

The CFOs surveyed by Savannah may have been less concerned with what industry a succession candidate comes from, but they did express more interest in having sufficient diversity in the shortlist. Gender diversity, in particular, appears to still be leading the corporate inclusion agenda, with 54 percent of CFOs saying it is important or very important to have gender-diverse candidates, compared with 43 percent saying the same about ethnically diverse candidates. Savannah anticipates that diversity in all recruitment searches will continue to be sought as organisations recognise how a more diverse workforce powers a better work environment and stronger, more balanced decision-making.

Though diversity and external perception from investors will play a part in the search for a CFO, the final decision will always be based on who the CEO and board have the most confidence in to deliver success for the business. Savannah recently placed two people who worked together as CEO and CFO at a previous company into the same roles at a multinational corporation. Though the CEO didn’t deliberately set out to hire his former CFO, he ended up gravitating to somebody he knew was loyal to him and understood him, and he was confident they would hit the ground running from day one.

Route to the Top

COVID-19 has heightened the risk profile of any senior hire, though it is in fact the level below CFO, finance professionals aspiring to be CFO in the coming years, where churn has slowed during the pandemic. This is both because people consider it risky to change jobs amidst the uncertainty and because companies have been less willing to make changes of their own. Savannah has engaged with one company, for example, that held off from removing underperformers because the CEO felt it was wrong during the pandemic and hard to onboard new people remotely. The ‘wait until things have settled’ approach was also observed by Savannah with Brexit, although eventually change can be delayed no further.

When it comes to the internal succession route, there is no obvious one when it comes to reaching CFO level. The reality is that some outstanding people never make it and some less able people do. Much of it comes down to timing, and to a certain degree of luck, particularly with regard to the prior point around external perception at the time of succession. The most obvious internal step-up remains from the group function – Group Financial Controller or Deputy CFO – mainly because the board feels comfortable having already had access to them. Those in a divisional finance team in a decentralised business are afforded little access to the board and may therefore be overlooked should a new CFO be required.

While CEOs and boards will ultimately seek the best CFO for the job, the increasingly natural progression from CFO to CEO is unlikely to escape their minds. As mentioned in part two of this report, CEOs want somebody who will help them in their role and, should it come to it, be their successor. This means that while opting for somebody who ticks the right CFO boxes, many CEOs will also identify somebody whose career they can consciously manage to ensure exposure across an ever-more complex business.

In a business landscape only becoming more complex and challenging, CEOs will want a CFO that fills some gaps they perceive in their own capabilities, as well as providing opportunities for the CFO to develop and be primed for CEO succession if necessary. If that is indeed what a CFO wants, and not all do, Savannah advises them to communicate that to the CEO, take their time, build confidence and then make the move if and when the opportunity arises.

5 Questions for organisations to answer when hiring a CFO:

- How does this hire play into the wider context of what is expected of the business at this time?

- What are the relative weaknesses in the CEO that this CFO hire could help offset?

- Have we weighed the pros and cons of internal versus external candidates?

- Is the highest calibre internal successor suitable for the CFO role at this time?

- Are we viewing this CFO hire as a potential CEO at a later stage should an unexpected succession event be required?