As businesses face rising investor expectations, evolving unit economics, and a push toward more real-time performance insight, FP&A is taking centre stage. But while the function’s importance is growing, the available talent pool is still restricted for the most in demand skills.

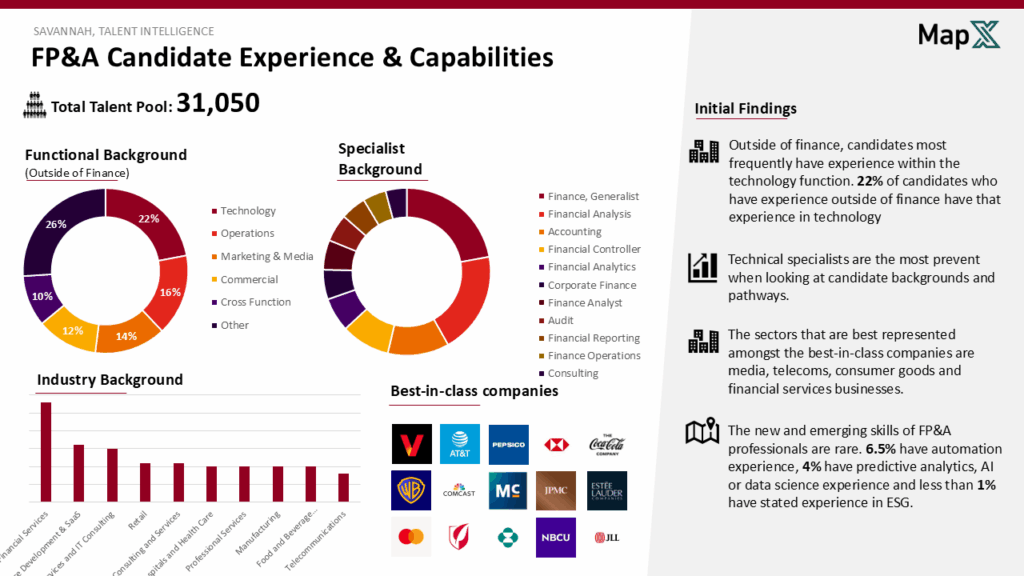

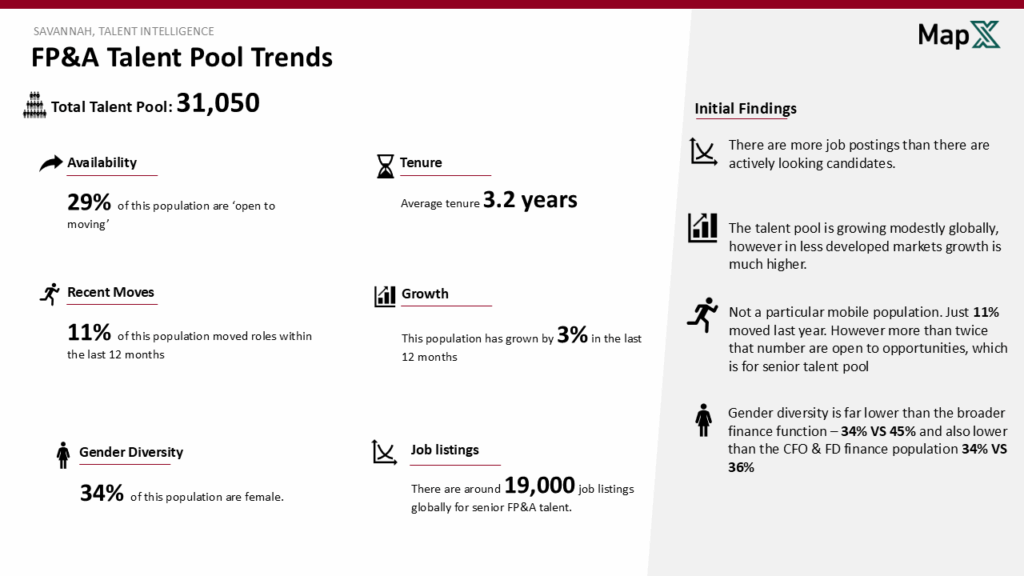

Savannah’s Talent Intelligence analysis of 31,000+ global senior FP&A professionals reveals a market that’s becoming more specialised but also more constrained:

- Only 6.5% have experience in automation

- Just 4% report skills in predictive analytics, AI or data science

- Fewer than 1% have hands-on ESG experience

And yet, these are precisely the capabilities that modern finance leaders are now expected to embed in their teams.

What the data tells us about the market

Savannah’s recent review of the global FP&A talent market reveals several important trends for hiring and succession planning:

- FP&A talent is staying put. While 29% are open to considering new opportunities, few are moving, suggesting that candidates are difficult to persuade into new roles or businesses are holding out for individuals who they consider a perfect match.

- The average tenure is just 3.2 years, meaning organisations must be prepared for regular leadership transitions in this space.

- The gender diversity gap is notable: Only 34% of senior FP&A professionals are women, well below the broader finance population (45%) and even behind CFO/FD benchmarks (36%)

This suggests a significant capability gap as organisations invest in finance transformation and digital reporting infrastructure.

How forward-thinking CFOs are responding

To navigate this talent challenge, leading CFOs are rethinking how they define, attract, and retain FP&A talent.

- Broadening the search profile

Rather than focusing solely on traditional industry or public company experience, many are exploring adjacent sectors like media, telecoms, and consumer goods, where analytical maturity is often stronger.

- Investing in internal development

Given the rarity of skills like predictive analytics and automation, some businesses are focusing on upskilling internal finance talent, building future FP&A capability from within.

- Using talent intelligence to test market feasibility early

By accessing real-time talent market data, CFOs and Talent Acquisition teams can stress-test role requirements before launching a search, avoiding delays and false starts.

- Prioritising flexibility and retention

With high demand and low mobility, offering flexible working patterns, clearer development pathways, and cross-functional exposure has become key to retaining FP&A leaders.

What this means for CFOS: benchmark, rethink, evolve

The data is clear. FP&A has become one of the most strategically important functions in finance, but the skills needed to future-proof these teams like automation, predictive analytics and AI remain in short supply. Movement in the market is limited, yet 29% of senior professionals say they are open to new opportunities. That creates a narrow but valuable window for CFOs who want to get ahead.

For most organisations, the question is whether the current structure, capability mix and leadership are set up to meet the demands of a more complex, data-driven business environment.

At Savannah, we support CFOs by:

- Benchmarking their existing FP&A function against the wider market

- Identifying and hiring high-calibre talent to support growth, transformation or succession

- Providing real-time insight into the availability and scarcity of key capabilities

If you’re reassessing how your FP&A team is positioned for the future, we’d be happy to share what we’re seeing across your industry and market. You can reach us at enquiries-clients@savannah-group.com