Download the full report here >

Introduction: The Three Vs

Today’s business environment is characterised by three fundamental forces: volatility, variability, and velocity. These Three Vs are reshaping the strategic landscape and overturning traditional assumptions that have guided corporate leadership for decades. Organisations that fail to adapt risk being blindsided by developments they cannot anticipate and constrained by governance models that no longer reflect market realities.

Volatility of events

‘Black swan’ disruptions have become the norm. The Covid-19 pandemic was an early wake-up call, demonstrating how quickly operating models could break down, sometimes irreparably. Since then, boards have faced supply chain failures, geopolitical crises, climate-related shocks, and the rapid emergence of generative AI. This is not a world for annual strategic planning cycles and quarterly reviews. Boards that plan on the basis of predictable, incremental change will soon be left behind.

Variability of markets

Macroeconomic uncertainty, algorithmic trading, and retail investor behaviour are all driving sharp swings in financial markets while trade war dynamics and regulatory divergence increase geographic variability. At the same time, digital transformation is blurring traditional sector boundaries, intensifying competition in unexpected ways. Board strategies must now be robust enough to perform across diverse market conditions rather than optimised for a single set of assumptions.

Velocity of change

Change itself is not new. The pace of change, however, has now accelerated beyond the point where traditional commercial models and organisational structures are capable of adapting in time to deal effectively with novel business challenges for which no established playbook exists. Product development cycles that once took years now happen in months. Market-leading positions can be lost in quarters rather than decades. This velocity is especially evident in technology adoption, where generative AI has moved from research curiosity to business imperative in a few short years.

These three forces – volatility, variability, and velocity – create a business context that demands a fundamentally different approach to leadership, at both executive and board levels. Traditional governance models, designed for stable, predictable environments, must evolve to address the realities of continuous disruption, multiple market scenarios, and compressed decision cycles.

To learn more about how next generation boards are adapting to this reality, Savannah Group interviewed and surveyed over 170 executive and non-executive board leaders across diverse industries. We asked the group the following questions:

- What do you believe are the fundamental challenges facing boards in an increasingly volatile and uncertain business environment?

- In that context, what do you think the key priorities are for the Chair and the board?

- Given those priorities, what do you think the implications are for board composition going forward?

- As a consequence of those shifting priorities, how is the role changing for the Chair?

- What traits and skills do you believe will be increasingly needed by future Chairs?

- What should be the background and experience of the most effective Chairs?

- Can you rank the priorities for the relative importance of board agenda items?

- Is there anything not included in that list that you believe is particularly important for boards at the moment?

Seven key takeaways from the board leaders surveyed

1. Scenario planning beats linear strategy

Linear strategy is increasingly obsolete in a world defined by rapid, unpredictable change. Scenario planning builds resilience by preparing boards for multiple potential futures, not just one. Boards must balance strategic direction with organisational agility, for example by using 70% decision frameworks or action corridors.

2. The Chair must be a facilitator, not a figurehead

Modern chairs succeed by facilitating collective intelligence – not by being the dominant voice in the group. Emotional intelligence, humility, and discernment are key, as they enable chairs to channel diverse perspectives into a coherent whole. Former CEOs may struggle as chairs unless they are able to adapt from a directive to a more collaborative approach.

3. Digital and AI literacy is no longer optional

AI and digital literacy are now baseline competencies for all board members, not optional extras. Every board member is accountable for upskilling themselves in digital, cybersecurity, and AI. Technical mastery is not essential, but they must at least understand the business applications and risks. Boards should resist appointing “digital-only” directors and instead tap internal executive knowledge and external specialist advisors.

4. Outside-in thinking eliminates blind spots

Boardroom groupthink remains one of the most persistent threats to effective governance and avoiding this requires cognitive diversity, not just demographic diversity. Boards should supplement core directors with external specialists or board apprenticeships to inject expertise. Monitoring competitors must become a systematic, frequent practice, not an occasional exercise.

5. Future chairs must be adaptive and change-driven

The most effective chairs combine experience with intellectual curiosity, embracing change with a growth mindset. Risk needs to be reframed – in a fast-changing environment, the bigger danger often lies in standing still. Discernment is critical – chairs must be able to distinguish between transformative change and passing fads.

6. Cybersecurity is the ultimate board stress test

Cybersecurity has leapt up the list of board priorities, eclipsing issues like ESG and D&I. Cyber incidents present ethical dilemmas as well as operational, financial and reputational threats. Boards must move from theoretical risk frameworks to practical readiness, including crisis simulations.

7. Leadership succession planning remains a top priority

Boards must plan for the future, avoiding comfort bias and looking beyond yesterday’s wins. Succession planning should be embedded in strategic rhythm – continuous, not episodic. Effective outcomes depend on leadership support systems, not just on the leaders themselves.

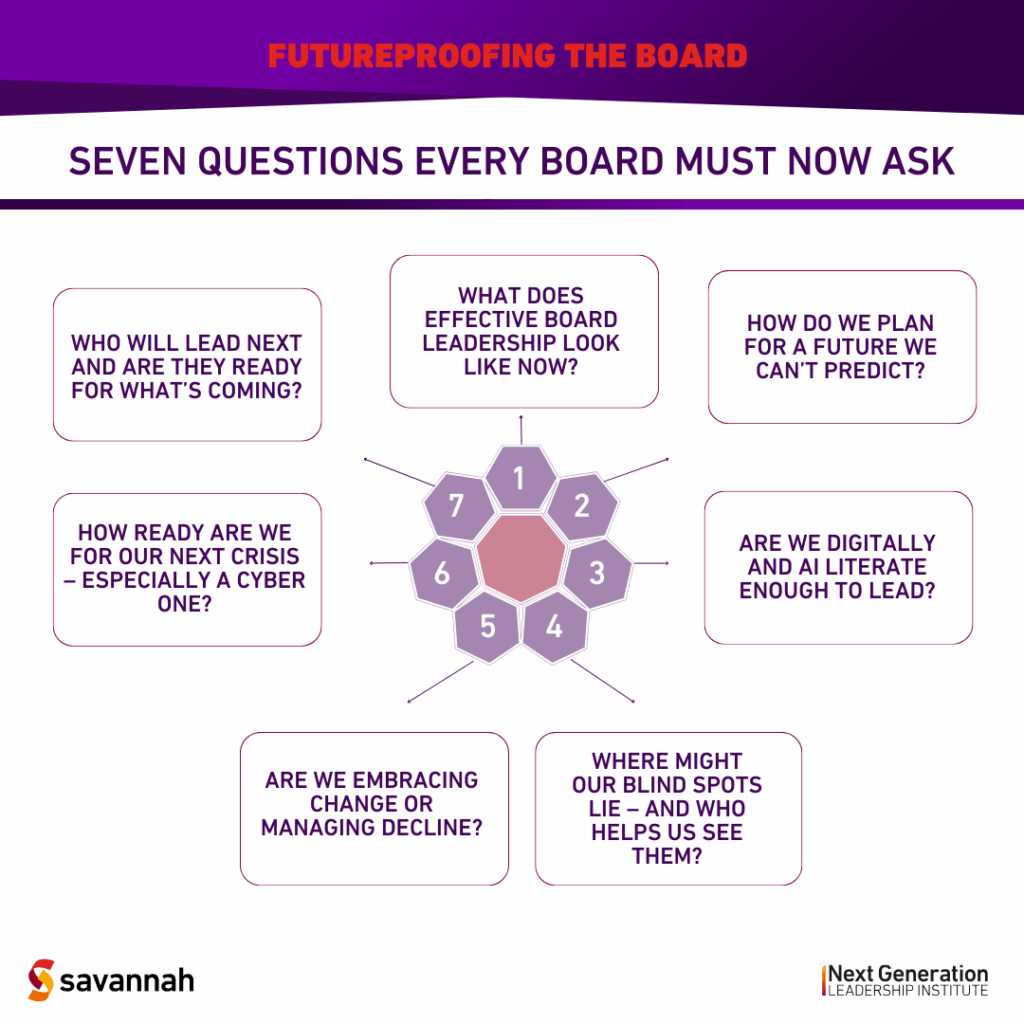

Future-proofing the board: Seven questions every board must now ask

Dealing effectively with the impact of the Three Vs — Volatility, Variability, and Velocity — on global business requires Next Generation Board thinking and a new breed of chair: adaptive, technologically fluent, and psychologically safe enough to think the unthinkable.

Board effectiveness is no longer about who predicts the future best, it is about who is best prepared for whatever future arrives.

To discuss your Next Generation Board please contact Chris Donkin or Angela Hocter.