After an explosion of technology talent hiring through the pandemic, leaders are now pausing to consider how best to shape and grow technology fire power.

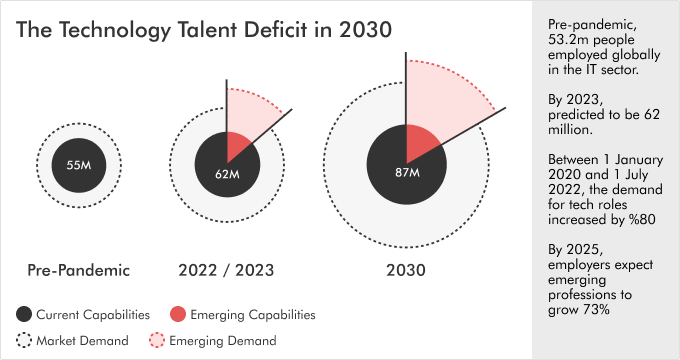

Overall, there is simply not enough technology talent for the number of jobs available. McKinsey predicts that we will experience more technological progress in the next decade than we did in the previous 100 years.

However, in reality the technology talent conundrum is more nuanced. While there is a demand surplus in general, the pandemic-fuelled hiring frenzy has cooled. In 2021, the technology sector saw also the highest resignation rates among all industries in the US. Yet the need for specific, emerging capabilities is hotter than ever.

A number of tech giants like Meta, Google, Netflix and more recently Twitter, traditionally attractive homes for top talent have announced hiring freezes or layoffs this year. Whilst a symbol of greater economic uncertainty, this presents an opportunity for others in the industry to catch the eye of high-quality talent which would otherwise be unavailable.

Breaking down the emerging technology talent deficit

The technology talent deficit will continue to grow. Over the next decade there will be a global shortfall of 18.2 million IT-related workers. Global technology talent has increased by 7% in the last two years, but this falls short of the demand. Over 2.5 million IT jobs will go unfilled by 2022, rising to 5.5 million by 2025.

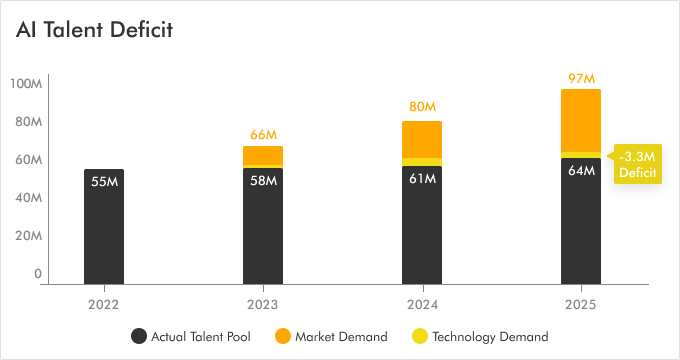

AI Talent

The World Economic Forum’s “The Future of Jobs Report 2020” predicts that AI will create 97 million jobs across all functions by the year 2025, increasing from 55 million currently. Savannah anticipates that 1 in every 10 of these jobs will be in technology.

However, according to Savannah research, globally there are currently under 5 million tech professionals in AI and that capability is growing at just 5% a year. If that growth rate continues, by 2025 there will be a deficit of over 3 million AI tech workers.

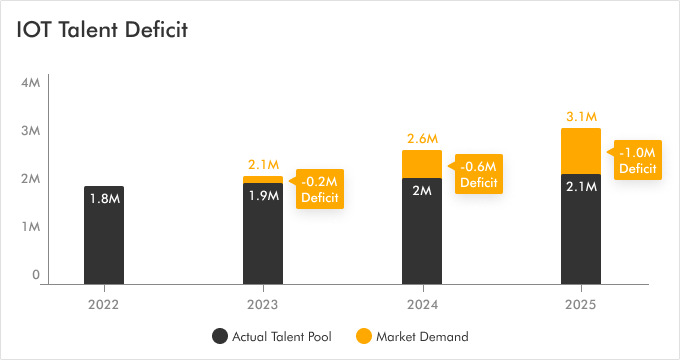

IOT

It is projected that there will be over 30bn IoT devices online by 2025, up from 16.4bn today (Statista),with McKinsey estimating that between $5.5 trillion and $12.6 trillion could be unlocked globally by 2030.

However, a 2021 study by Inmarsat found just 20% of organizations have the skills needed to successfully integrate IoT into their operations.

We found that IoT talent capabilities are growing at 4.6% a year, not nearly enough to meet the increasing demand through 2025 and into 2030.

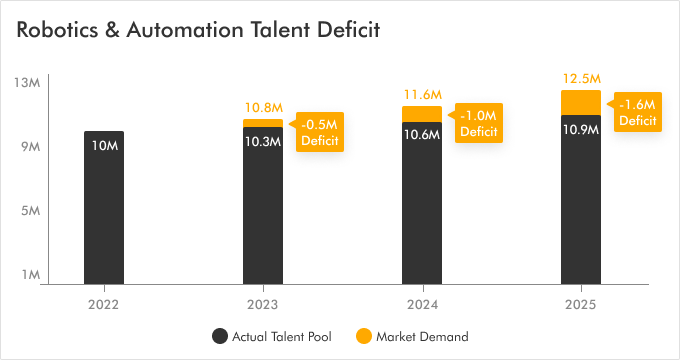

Robotics & Automation

The global robotics market was valued at around US$ 31 Billion in 2020 and the market is expected to register a double digit CAGR over the forecast period of 2021 – 2025.

The wide-ranging adoption of robotics technologies across a broad spectrum of industries has bolstered recent growth. A Deloitte analytics study found that up to 80% of industrial U.S. employers are facing problems with filling their vacancies for highly skilled professionals, including robotics, computer vision, motion control, and integration of industrial equipment.

As organisations are finding it difficult to source qualified candidates, demand continues to grow. The U.S. Bureau of Labour Statistics found that the global demand for qualified robotics professionals in 2018 grew by more than 13%.

Savannah’s research shows that growth within the talent market cannot keep up with the faster rate of growth in skills demand. As a result, we will continue to see the skills gap widen.

Cyber Security

According to the ISC Cybersecurity Workforce Study in 2019, there is a significant global talent deficit in this field. It estimates that the US market alone would have to increase by 62% to meet the demand for businesses today.

Our research has found that while workforce size has remained relatively consistent during the same period (1.44% annual growth), the deficit has continued to grow. Cybersecurity Ventures predicts the talent gap to reach 3.5 million in 2025. During the eight-year period this data has been tracked, the number of unfilled positions has increased by 350%.

Need to hire tech talent?

Savannah’s team helps the world’s leading companies identify the technology talent they need to build dynamic teams.

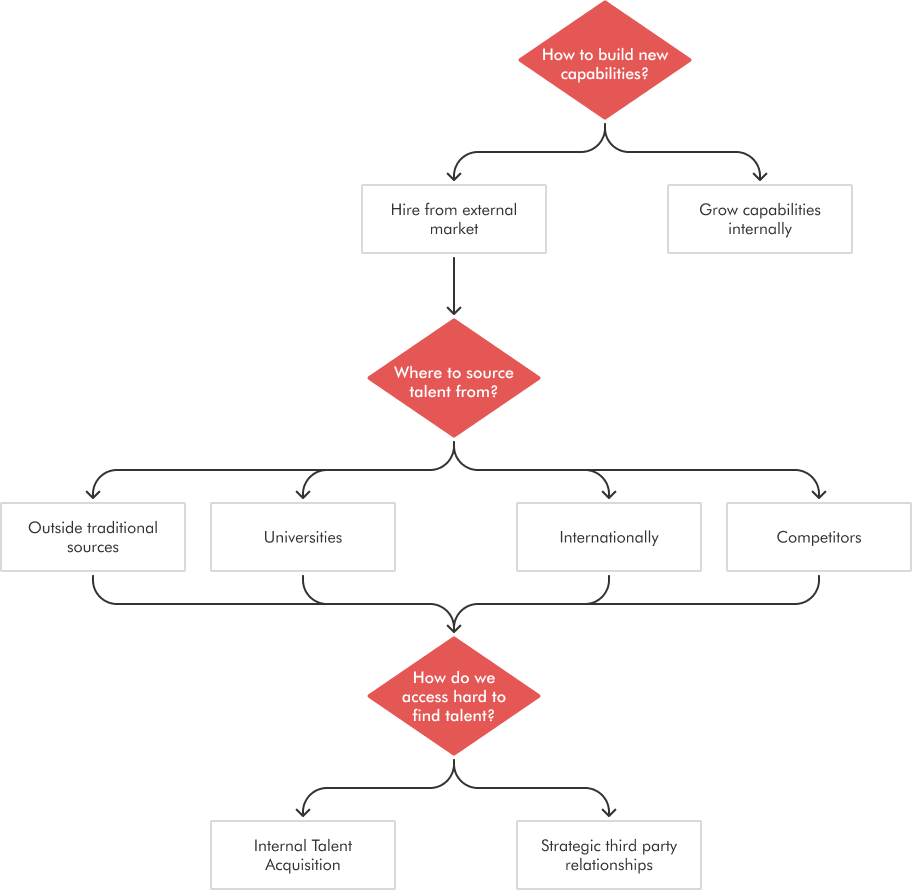

Addressing The Emerging Technology Talent Deficit

Given the size of this technology talent deficit, how can you get ahead as a business? Savannah Group has created a decision-making framework to help you plan how you acquire or grow tech talent. In this article we’ll explore each section in turn. You can use this framework with your CEO, HRD and CTO to create a talent strategy that takes advantage of a variety of approaches to attract talent within the emerging fields of AI, IoT and Cybersecurity along with other technology capabilities.

How to build new capabilities?

The first decision is whether to grow capabilities internally or hire from the external market. There are various pros and cons to each of these approaches and the answer often lies between the two. Considering your future growth journey and the role of emerging technology in your five-year business strategy can help you estimate the number of roles you will need to hire for over subsequent years, what levels of skill you will need in each and who will lead those functions.Grow capabilities internally

- Cost effective

- Creates development paths for more junior resources to advance their career

- Benefits for talent retention if potential advancement is clear retention

- Requires enough graduate and junior talent flowing into the business to meet team size targets in future years

- Not sufficient if more senior or specialist roles are required in the short term

- Limits overall team exposure to best practices found in other businesses

- Limits diversity of thought

- Requires a strong people and talent team to build development plans

Hire from the external market

- Can be rapidly scaled

- Can hire at junior, mid and senior levels concurrently

- Opportunity to acquire individuals with particular backgrounds/experiences of interest

- Can hire for specific specialisms at short notice

- Either requires a talent acquisition team or help from third parties which can be expensive

- Can harm talent retention if junior resources don’t see a future development path for them

- Complexities around orientating new people to the business’s culture, purpose and vision

European Tech Hub Analysis Report

Download our report on the best low-cost locations in Europe to hire tech talent in data science, cloud, ops, engineering and more.

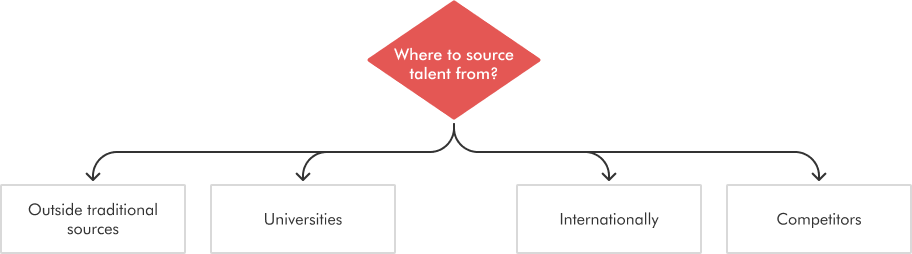

Where to Source Talent From?

A thorough and sophisticated approach would involve accessing a broad range of industries, types of organisation and locations.

How to build new capabilities?

- Likely to be familiar with your business model, industry jargon and customers

- Functional structures will likely be similar to yours

- Limited talent pool

- High competition for the best people

- Emerging technology is more industry agnostic and therefore industry experience is often less important

- Better talent might be found elsewhere if your industry is not at the bleeding edge in any of these emerging tech fields

- Larger talent pools are able to be accessed

- High number of STEM individuals in many lower cost locations

- Potential language and timezone barriers

- Given the increased size, identifying talent in international markets can be time consuming

- Can identify talent under the radar of others

- Can help to increase diversity

- Large addressable talent pool

- Ability to acquire a variety of backgrounds and experiences

- Knowing which other industries and companies are relevant to hunt in

- Complexities around seniority titles and pay structures makes direct comparisons between candidates more nuanced

- Candidate transferability between industries isn’t always successful

- Need a strong EVP (employee value proposition) to explain why they should join you vs others who have a more recognisable name in the talent market

- Gets you close to large influxes of new STEM talent

- Leading STEM universities produce high quality graduates

- Need a good graduate recruitment and employer brand team

- Typically a mid to long term strategy

How do we access hard to find talent?

The final question to answer is how to access talent. Two main options exist and will depend on the size, sophistication and capabilities of talent acquisition.

Internal Talent Acquisition

- Talent intelligence and recruitment tools available to help execute technology strategy

- In house teams know and understand your business

- Many TA teams struggle with capacity with high numbers of hires required over the last 24 months

- Some TA teams lack expertise in emerging technology fields

Strategic Third-Party Relationships

- Bring expertise in technology talent strategy

- Knowledgeable about the market outside of your industry

- Can provide contract, interim or permanent hires

- Fees can be high

- Varying quality among providers

Conclusion

While competition for technology talent is at an all-time high and set to only get more fierce, there are a variety of strategies available for creatively identifying and attracting talent in AI, IoT and Cybersecurity. With slowdowns in big tech hiring and a wider number of relevant companies to hire from, opportunities exist for businesses that develop a plan and proactively map relevant markets while building efficient engagement, attraction and onboarding capabilities. Outside of external hiring, developing attractive career paths within AI, Cyber and IoT is a must for retaining existing talent.

Need to hire tech talent?

Savannah’s team helps the world’s leading companies identify the technology talent they need to build dynamic teams.