Executive Summary

The global energy transition represents one of the most profound economic and industrial shifts in modern history, predicated on a move away from a fossil fuel-based system to one powered by clean energy technologies. This transformation, however, is fundamentally a materials transition. It necessitates an unprecedented expansion in the extraction and processing of a suite of critical minerals including lithium, copper, cobalt, nickel, graphite, and rare earth elements that form the physical bedrock of electric vehicles, wind turbines, solar panels, and expanded electricity grids. The scale of this demand creates a colossal investment challenge, with credible estimates placing the required new capital for mining in the hundreds of billions, and even trillions, of dollars by mid-century.

This report addresses the central question of whether the private finance world, and specifically the private equity (PE) sector, possesses the capacity and appetite to fund this mineral-intensive future. The analysis reveals a deep and complex tension. On one hand, the sheer scale of the long-term, non-negotiable demand for these minerals presents a compelling, secular growth opportunity that is attracting a diverse and expanding ecosystem of investors, including a marked increase in private equity activity. PE’s traditional advantages, a long-term investment horizon away from public market pressures and a focus on operational value creation, seem well-suited to the lengthy and complex development cycle of new mines.

On the other hand, the mining sector presents a formidable gauntlet of interconnected risks that have historically kept generalist investors at bay. These include a fundamental structural mismatch between the 15-to 20-year timeline of mine development and the typical 10-year life of a PE fund; extreme commodity price volatility that can decimate project economics; profound geopolitical and sovereign risks stemming from the geographic concentration of mineral resources and processing capacity; and an increasingly stringent Environmental, Social, and Governance (ESG) mandate that has evolved from a peripheral concern into a core determinant of project viability and market access. These risks do not operate in isolation but form a self-reinforcing system of “compounding risk” that can render projects un-investable.

The conclusion of this report is that while traditional, standalone financing models are insufficient to bridge the trillion-dollar gap, a new paradigm of collaborative, de-risked investment is emerging out of necessity. This new model is characterised by deep strategic partnerships between miners and downstream users like automotive and battery manufacturers, who provide offtake agreements and direct capital to secure their own supply chains. It is catalysed by proactive government industrial policies, such as the U.S. Inflation Reduction Act, which use subsidies and sourcing requirements to create protected, more predictable investment environments. Finally, it is being executed through a “new capital stack” of blended finance, where specialist PE funds, climate-focused generalist funds, government-backed entities, and strategic corporate investors each play a specific role in allocating and mitigating risk across a project’s lifecycle.

Private equity is not the sole savior of the critical minerals supply chain, but it is an indispensable component of this evolving ecosystem. Its role is shifting from that of a standalone financier to a crucial intermediary, a sophisticated partner with the technical and financial expertise to shepherd high-risk projects through development, but doing so within a broader, de-risked framework supported by strategic and public-sector actors. The success of the energy transition may well depend on the speed and efficacy with which this new collaborative financing model can be scaled globally.

Section 1: The Unprecedented Demand: Sizing the Mineral Chasm

The global commitment to decarbonisation and the pursuit of net-zero emissions targets have set in motion a structural transformation of the world’s energy systems. This shift is not merely about replacing one form of energy generation with another; it is a fundamental re-plumbing of the industrial economy. At its core, the energy transition is a materials transition, exchanging a reliance on the extraction of fossil fuels for an intense and growing dependency on the mining of critical minerals and metals. Understanding the sheer scale of this new demand is the essential first step in assessing the financial challenge of meeting it. The demand profile for these materials is not cyclical or temporary; it is a permanent, structural shift that underpins the entire economic viability of a low-carbon future.

1.1 The New Oil: Critical Minerals as the Engine of Decarbonisation

The technologies at the heart of the energy transition, electric vehicles (EVs), battery storage, solar panels, and wind turbines, are significantly more mineral-intensive than their conventional fossil fuel-based counterparts. [1] This increased material intensity is a defining feature of the new energy economy. Analysis by the International Energy Agency (IEA) reveals that since 2010, the average quantity of minerals required for a new unit of power generation capacity has surged by 50%, a direct consequence of the rising share of renewables in new energy investment. [2]

The contrast is stark across specific technologies. An electric vehicle, for instance, requires six times the mineral inputs of a conventional internal combustion engine car, while an onshore wind plant demands nine times more minerals than a gas-fired power plant of equivalent capacity. [1] This reality has elevated a specific group of minerals to a status of strategic importance, akin to that of oil in the 20th century. These “critical minerals” are not interchangeable commodities but are essential, functional components whose unique properties enable modern clean energy technology.

The key minerals and their roles are clearly defined [3]:

- Battery Minerals: The performance, energy density, and cost of lithium-ion batteries, which power EVs and stationary storage systems, are critically dependent on lithium, nickel, cobalt, manganese, and graphite.

- Magnet Minerals: The high-strength permanent magnets essential for the motors in most electric vehicles and the generators in direct-drive wind turbines rely on rare earth elements (REEs) such as neodymium, praseodymium, dysprosium, and terbium.

- Electrification Minerals: The expansion and reinforcement of electricity networks, a prerequisite for integrating variable renewables and supporting widespread electrification, require vast quantities of copper and aluminium. Copper, in particular, is described as the “cornerstone of all electricity-related technologies” due to its superior conductivity. [3, 4]

This intrinsic link between clean energy deployment and mineral extraction means that the global push for decarbonisation is, by definition, a mandate for a massive expansion of the mining industry. [5, 6] The transition is not simply about innovation in energy technology; it is inextricably tied to the physical world of geology, extraction, and processing. This creates a non-negotiable, long-term demand signal that forms the basis of the investment thesis for the entire critical minerals sector.

1.2 Projecting the Surge: A Multi-Scenario Demand Outlook

The projected growth in demand for these critical minerals is explosive and historically unprecedented. The IEA has modelled future mineral requirements under various scenarios, all of which point to a dramatic and sustained increase in consumption driven overwhelmingly by the clean energy sector.

Under the Stated Policies Scenario (STEPS), which reflects current policy settings and announced pledges, the demand trajectory to 2040 is already formidable. Lithium demand is projected to increase fivefold from today’s levels, while demand for graphite and nickel is set to double. Consumption of cobalt and rare earth elements is expected to grow by 50-60%, and copper, which already has a large established market, will see demand rise by 30%. [7]

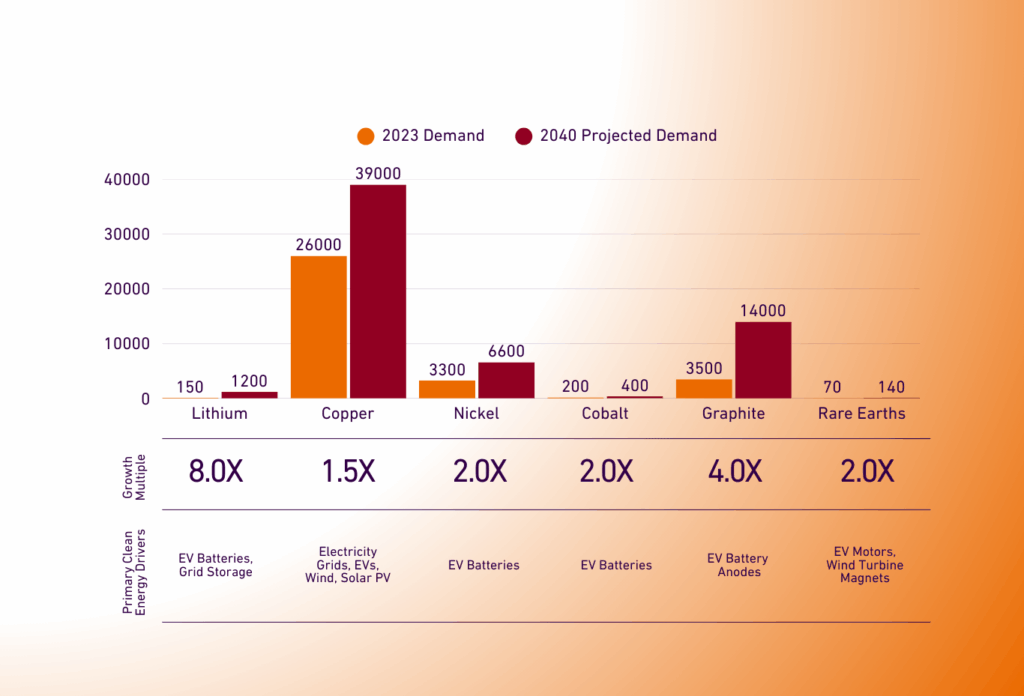

However, in a scenario aligned with more ambitious climate goals, such as the Net Zero Emissions by 2050 (NZE) Scenario, the growth rates are staggering. The IEA projects that to achieve net-zero by 2050, the total demand for mineral inputs in 2040 would need to be six times greater than it is today. [2] The growth for individual minerals in this scenario is even more acute [8]:

- Lithium demand experiences an eightfold increase by 2040.

- Graphite demand grows fourfold.

- Nickel, cobalt, and REEs see their demand double.

- Copper demand rises by 50%.

A crucial aspect of this demand surge is the shifting composition of end-use markets. Clean energy technologies are rapidly becoming the dominant consumer for most of these minerals. In a climate-aligned scenario (the IEA’s Sustainable Development Scenario, or SDS), by 2040, the clean energy sector’s share of total demand is projected to reach [9]:

- Almost 90% for lithium.

- Between 60-70% for nickel and cobalt.

- Over 40% for copper and REEs.

This represents a fundamental restructuring of global commodity markets, where the fortunes of these minerals will be inextricably linked to the pace of the energy transition. The demand is not an incremental addition to existing markets; it is a wholesale reorientation of these markets around a new primary driver. The velocity of this change, particularly for battery metals like lithium, places extreme pressure on global supply chains that were designed for a much smaller and more stable market environment.

Table 1: Critical Mineral Demand Growth in the Energy Transition (IEA NZE Scenario, 2023-2040). Data compiled and synthesised from IEA reports. [7, 8, 9] Note: Figures are approximate and illustrative of the scale of growth projected in the NZE scenario.

1.3 The Investment Imperative: Translating Demand into Dollars and Deficits

The projected surge in mineral demand is running headlong into a global supply pipeline that is demonstrably inadequate. Today’s supply and investment plans fall far short of what is needed to support an accelerated deployment of clean energy technologies. [5] This disconnect creates two critical outcomes: a massive capital investment gap and the high probability of significant supply deficits for the most essential minerals in the coming decade.

Estimates for the required capital investment vary but are consistently colossal in scale. Different analyses underscore the magnitude of the financial challenge:

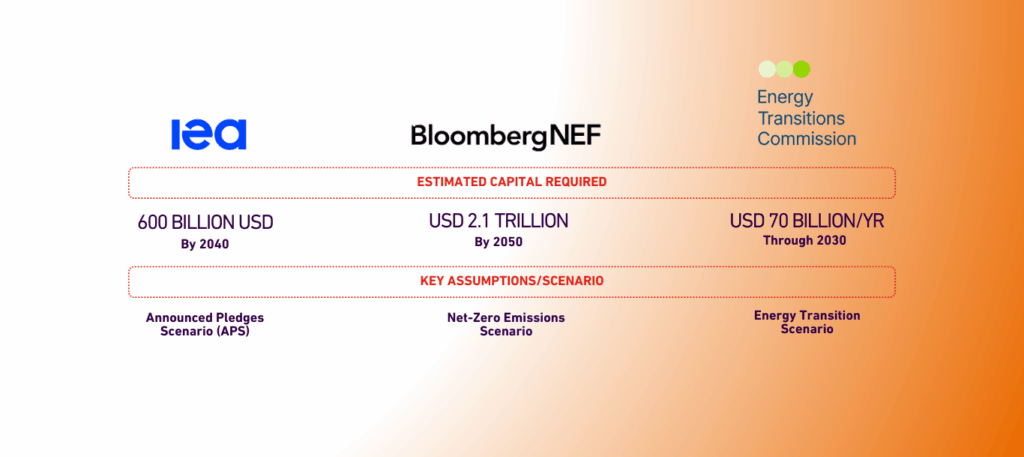

- The International Energy Agency (IEA) calculates that between now and 2040, approximately USD 500 billion in new capital investment is needed for mining to meet demand under the STEPS scenario. This figure rises by 15% to USD 600 billion in the more ambitious Announced Pledges Scenario (APS). [7]

- BloombergNEF (BNEF) presents an even more daunting figure, estimating that USD 2.1 trillion in new mining investment will be required by 2050 to meet the demands of a net-zero emissions world. [10]

- The Energy Transitions Commission (ETC) focuses on the immediate term, concluding that annual capital investments in key energy transition metals must increase from the current $45 billion to an estimated $70 billion per annum every year through to 2030. [11]

Table 2: The Multi-Trillion Dollar Capital Gap for Critical Minerals. Data compiled from multiple sources to illustrate the consensus on the massive scale of required investment.

This vast capital requirement is set against a backdrop of weakening investment momentum. Spending on critical minerals mining grew by only 5% in 2024, a significant slowdown from the 14% growth seen in 2023. [3] This deceleration sharpens the outlook for future supply shortages.

The IEA’s analysis of the project pipeline reveals alarming potential deficits. Even with all announced projects coming online, by 2035 the world could face an implied supply deficit of 40% for lithium and 30% for copper under the STEPS scenario. [7] Looking at a nearer-term horizon, expected supply from existing mines and projects currently under construction is estimated to meet only half of the projected lithium and cobalt requirements and just 80% of copper needs by 2030 in a scenario consistent with climate goals. [2]

The supply gap for copper is particularly concerning. The challenge is compounded by structural issues, including steadily declining ore grades at existing mines, which increases the cost and complexity of extraction; rising capital intensity for new projects; and a sharp slowdown in the discovery of new, high-quality resources. [7, 12] For lithium, while the near-term market may appear well-supplied, the exponential growth in demand from EVs is projected to push the market into a structural deficit by the 2030s. [7, 8]

This quantified gap between future needs and current reality is the central problem that private capital is being called upon to solve. The scale of the challenge is so vast that it represents not just a cyclical upturn for the mining sector, but a permanent, structural re-foundation of the global energy economy. This is not merely a “mining boom”; it is the essential infrastructure build-out for a new economic paradigm. This implies that the required investment is strategic, long-term, and of national and international importance, a fact that fundamentally alters the nature of the investors involved and the role of governments in the process. The predictable long-term deficits create a strong investment thesis based on rising future prices, but this is a double-edged sword. The path to higher prices will be marked by the extreme price volatility that has already been witnessed in markets like lithium. [13] This volatility creates a vicious cycle: the promise of high future returns is necessary to attract capital, but the short-term price instability, which is a direct result of market imbalances and long project lead times, actively deters the very investment needed to resolve the deficit in the first place. [14, 15] Breaking this cycle is the core challenge for financiers, mining companies, and policymakers alike.

Section 2: The Evolving Landscape of Mining Finance

The multi-trillion-dollar investment requirement for critical minerals has triggered a profound shift in the landscape of mining finance. The sheer scale of the opportunity, driven by the non-negotiable demand of the energy transition, is drawing in new sources of capital and forcing a re-evaluation of traditional investment models. Private equity, a sector historically wary of the mining industry’s unique risk profile, is now emerging as a pivotal player. However, it is not acting in isolation. PE is part of a diverse and increasingly interconnected ecosystem of investors, including specialist funds, strategic corporate actors, ESG-focused asset managers, and sovereign entities, each bringing a different risk appetite and strategic motivation to the table. This diversification of capital is creating a new, more resilient financial architecture for the mining sector, one in which private equity is positioned to play a crucial and evolving role.

2.1 A New Frontier for Private Equity

For decades, the bulk of private equity capital, particularly from generalist funds, has remained on the sidelines of the mining industry, deterred by its cyclicality, long timelines, and operational complexity. The energy transition has changed this calculation. The secular, long-term demand for critical minerals presents a growth narrative that aligns with PE’s focus on identifying and backing transformative industrial trends. As a result, private equity investment in mining is poised for significant and sustained growth. [16]

The data indicates that this shift is already underway. In the third quarter of 2023, the mining sector witnessed an unprecedented surge in private equity deal-making, with transactions totaling approximately $5.2 billion. This represented a staggering 1,377% increase compared to the previous quarter and a 2,145% increase over the same period in 2022. [17] This dramatic uptick in both deal value and volume signals a clear and growing interest from international PE investors.

This influx of capital serves a dual purpose. It provides much-needed funding for exploration and development, and it also acts as a powerful validation signal to the broader financial community. The participation of sophisticated PE firms is seen as a de-risking event in itself, which can help attract a wider pool of private capital, including generalist investors who may have previously perceived the risks associated with mining as insurmountable. [17] Private equity investors are drawn by the clear and significant growth potential of the critical minerals sector, but their entry is tempered by the need to navigate a complex and multifaceted risk landscape, spanning from exploration and extraction to processing and end-use markets. [18] The central theme of the current era is PE’s adaptation to this new frontier, developing strategies to harness the immense opportunity while mitigating the inherent challenges.

2.2 The Investor Spectrum: A Diverse and Evolving Ecosystem

The capital flowing into critical minerals is not monolithic. Private equity is one component of a complex and rapidly diversifying ecosystem of financial players. Understanding the motivations and roles of each segment is essential to grasping how the overall funding gap can be bridged. This ecosystem is increasingly characterised by a “blended finance” approach, where different types of capital collaborate across the project lifecycle. [19]

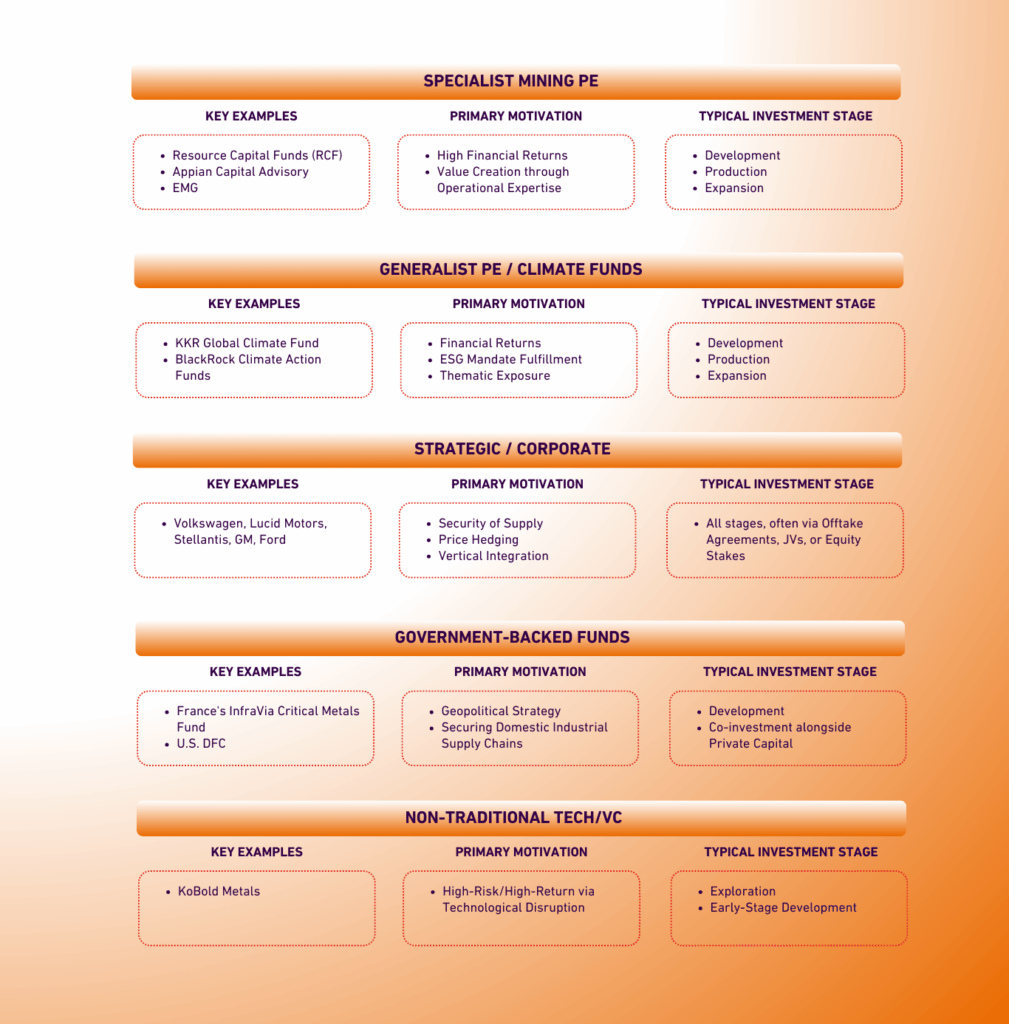

The key investor categories include:

- Specialist Mining PE Funds: These are the established players with deep sector-specific expertise. Firms like Resource Capital Funds (RCF), Appian Capital Advisory, and Energy & Minerals Group (EMG) have pioneered the private equity model in mining. They possess in-house technical teams, a long track record of bringing mines into production, and manage large, dedicated funds targeting the natural resources sector. RCF, for example, has over 25 years of experience and has invested in over 230 companies across 35 different commodities. [20] Appian focuses on matching quality assets with long-term capital and operating expertise [21], while EMG targets equity investments ranging from $150 million to $1 billion in high-quality resource projects. [22]

- ESG and Thematic Funds: A new and influential class of investors is channeling capital into mining through an Environmental, Social, and Governance (ESG) lens. This trend has created a significant alternative funding mechanism for critical minerals projects. [23] Major asset managers have launched thematic funds, such as the VanEck Green Metals ETF (GMET), which specifically targets companies deriving at least 50% of their revenue from “green metals” like lithium, copper, and cobalt. Large global investors like BlackRock and KKR have raised multi-billion-dollar climate funds that provide both debt and equity to sustainable projects, including those in the critical minerals supply chain. [23]

- Strategic and Corporate Investors: Perhaps the most significant development is the upstream movement of downstream consumers. To secure their own supply chains and mitigate price and availability risks, automotive original equipment manufacturers (OEMs) and battery makers are becoming direct investors in mining projects.[19] This trend is exemplified by Volkswagen’s investment in lithium developer Patriot Battery Metals and Lucid Motors’ formation of the MINAC collaborative with graphite and manganese producers. [24, 25] These partnerships often involve not just capital, but also binding long-term offtake agreements, which are critical for de-risking projects for other financiers.

- Government and Public-Private Funds: Recognising the geopolitical and economic importance of critical minerals, governments are no longer passive regulators but active market participants. They are acting as direct investors and catalysts for private capital. A prime example is France’s InfraVia Critical Metals Fund. Managed by a private equity firm but backed with up to €500 million in state funds, the vehicle aims to raise a total of €2 billion to take minority stakes in global mining, processing, and recycling projects. The explicit goal is to secure offtake contracts for the benefit of French and European industries, demonstrating a clear industrial strategy.[26]

- Non-Traditional Investors: The unique potential of the sector is also attracting novel sources of capital. Technology-focused investment firms like KoBold Metals, backed by high-profile individuals including Bill Gates and Jeff Bezos, are deploying capital alongside proprietary artificial intelligence and machine learning platforms to improve the efficiency and success rate of mineral exploration. [16, 19] This represents a fusion of venture capital-style tech investment with the heavy industry of mining. Other unconventional sources, such as wealth from the cryptocurrency sector, are also beginning to flow into mining operations. [16]

The rapid diversification of this investor landscape is a direct response to the multifaceted nature of the challenge. A single mining project has distinct risk profiles at each stage of its life: exploration is a high-risk, geological gamble; development is a capital-intensive construction and permitting challenge; and operation is a matter of production efficiency and cost control. The emergence of a “new capital stack” allows these different risks to be allocated to the investor best suited to bear them. For instance, an AI-driven explorer like KoBold can handle the initial discovery risk, a specialist PE fund like Appian can manage the development and permitting phase, a government-backed loan can de-risk the massive construction debt, and an automaker’s offtake agreement can guarantee the revenue stream needed to secure that debt. This layered, collaborative approach, often referred to as an “integrated capital stack,” is the key structural innovation enabling capital to flow into this challenging sector. [19]

Table 3: The Evolving Ecosystem of Critical Mineral Investors. This table categorises the key financial players, their motivations, and their typical roles in the emerging “new capital stack” for mining finance. Compiled from various sources. [16, 17, 19, 20, 21, 22, 23, 25, 26]

2.3 The Public-Private Tension and PE’s Unique Position

Within this new ecosystem, private equity occupies a unique and advantageous position relative to the traditional giants of the industry: the large, publicly listed, diversified mining companies. While these majors still account for a substantial portion of overall investment, their strategic focus and the pressures of public market ownership create opportunities for private capital to fill critical gaps. [3,12]

The fundamental tension lies in the time horizon of investment. Publicly traded companies are often driven by the rhythm of quarterly and annual earnings reports. This focus on short-term returns and stock price performance is poorly suited to the realities of greenfield mining projects, which can take 15 to 20 years from initial exploration to generating their first dollar of revenue. [11, 19] An investment made today may not yield returns for well over a decade, a timeline that is difficult to justify to public market investors seeking immediate results.

This is where private equity’s “natural advantage” comes into play. [19] Unencumbered by the constant scrutiny of public markets, PE funds can, in theory, focus more unambiguously on long-term value optimisation. They can patiently guide a project through the arduous and often-delayed processes of permitting, community engagement, and construction, the so-called “valleys of death” where many projects flounder for lack of sustained capital. [6] This ability to provide patient, strategic capital is precisely what is needed for new mine development.

However, the reality is more nuanced. The majors possess unparalleled operational expertise and economies of scale in running large, complex mines. Their recent focus has often been on M&A and brownfield expansions of existing assets rather than high-risk greenfield development, a trend that analysts argue must shift to meet future demand. [12] This creates a clear division of labor: the majors may be best equipped to operate and optimise producing assets, while private equity may be better structured to absorb the high-risk, long-duration development phase of new projects. The challenge for PE, as will be explored in the next section, is making the risk-return profile of these long-duration projects compatible with their own fund structures.

Section 3: The Gauntlet of Risk: Barriers to Capital Deployment

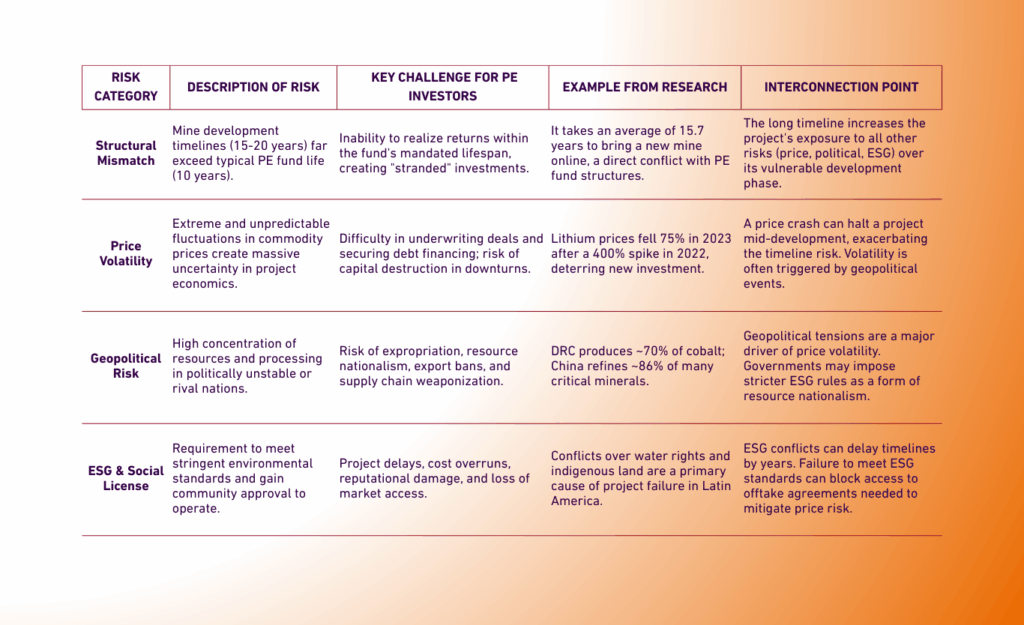

While the demand-driven opportunity in critical minerals is undeniable, the path to deploying capital is fraught with a unique and formidable set of interconnected risks. These challenges explain the historical reluctance of generalist private capital to enter the mining sector and continue to act as significant barriers to the investment required for the energy transition. The risks are not independent; they form a tightly woven system of “compounding risk,” where a challenge in one area exacerbates problems in others. Investors are not simply evaluating a list of discrete risks; they are assessing a complex, dynamic, and high-stakes system. Successfully navigating this gauntlet requires specialised expertise, robust due diligence, and innovative risk mitigation strategies.

3.1 The Structural Mismatch: Fund Lifecycles vs. Mine Timelines

The single greatest structural barrier for private equity investment in mining is the profound mismatch between the long, uncertain, and capital-intensive timeline of mine development and the shorter, finite life of a typical PE fund. This is not a minor operational hurdle but a fundamental conflict of business models that lies at the heart of the financing challenge. [16, 17]

Industry data consistently shows that bringing a new mine into production is a multi-decade endeavor. The average time from initial discovery to first commercial production can be anywhere from 15 to 20 years. [11,19] A recent study by EY places the average at a precise 15.7 years. [12] This long gestation period is characterised by high upfront capital expenditure for exploration, feasibility studies, permitting, and construction, all of which occurs before any revenue is generated. This phase is often described as crossing a series of “valleys of death,” where projects are highly vulnerable to losing funding and momentum due to technical setbacks, regulatory delays, or shifts in investor sentiment. [6]

This reality is in direct conflict with the standard private equity fund structure, which typically operates on a 10-year lifecycle with an investment period of three to five years and an expectation of realising returns before the fund is wound up. This limited duration makes it exceptionally difficult for PE firms to find investable mining assets that can be developed and exited within a timeframe that provides sufficient risk-adjusted returns for their limited partners. [16, 17] The long timeline inherently increases the probability of a negative event, a political shift, a commodity price crash, a community protest, occurring during the project’s most vulnerable development phase, thereby compounding all other risks. This structural mismatch explains why generalist PE has historically avoided the sector and why the firms that have succeeded in mining have had to develop specialised, longer-duration funds, focus on acquiring assets already in or near production, or target specific, de-risked stages of the development cycle where an exit is more clearly visible.

3.2 The Volatility Trap: Commodity Price Cycles as a Deterrent

Mining is a notoriously cyclical industry, and extreme commodity price volatility represents the primary source of financial risk for investors. [14] This is not just a feature of the market; it is a trap that actively deters the long-term, stable investment needed to smooth out the very supply-demand imbalances that cause the volatility in the first place. Minerals, ores, and metals are the most volatile commodity group, and their prices can fluctuate wildly based on macroeconomic trends, geopolitical events, and shifts in market sentiment. [27]

The recent history of critical mineral markets provides stark examples. The price of lithium carbonate spiked by over 400% in 2022, only to collapse by 75% in 2023 as new supply temporarily outpaced a slowdown in EV demand growth. [13] Cobalt has lost two-thirds of its value from its 2022 peak. This whiplash gives deeply confusing and unreliable signals to potential investors. In the face of low prices and uncertainty, mining companies are forced to delay projects, scale back exploration, and suspend operations, the exact opposite of the behaviour required to meet long-term demand. [13] Analysis by CRU Group suggests that in a commodity price downturn, development capital expenditure can fall by over 75%, crippling the project pipeline. [28]

This volatility is a leading concern for all investors, from PE funds to downstream manufacturers.[18] It creates massive uncertainty in project economics, making it difficult to model future cash flows and secure debt financing. [15] Furthermore, since raw material costs now account for 50-70% of the total cost of a lithium-ion battery, up from 40-50% just five years ago, mineral price spikes have a direct and significant impact on the affordability of clean energy technologies. A doubling of lithium or nickel prices would induce a 6% increase in battery costs, potentially slowing the pace of EV adoption and the energy transition itself. [2,10] This creates a feedback loop where price volatility not only deters investment in new supply but also threatens to dampen the very demand that justifies the investment.

3.3 The Geopolitical Chessboard: Sovereign Risk and Supply Chain Weaponisation

A mining project is no longer just a geological and financial asset; it is a geopolitical one. The value and risk of a mine are now determined as much by its location on the global map and the political stability of its host country as by its ore grade and production costs. The extreme geographic concentration of both mineral extraction and processing has created a high-stakes geopolitical chessboard, making sovereign risk and the potential for supply chain weaponisation a primary concern for investors. [29]

The concentration is acute at multiple stages of the value chain:

- Production Concentration: For many critical minerals, global output is dominated by a handful of countries. The world’s top three producers control well over three-quarters of the global supply of lithium, cobalt, and rare earth elements.[5] The Democratic Republic of Congo (DRC) alone produces approximately 70% of the world’s cobalt.[18]

- Processing Concentration: The concentration is even more pronounced downstream. China has established a commanding dominance over the refining and processing of most critical minerals. Its market share of refining rose from 82% in 2020 to 86% in 2024, with almost all recent supply growth for cobalt, graphite, lithium, and REEs coming from China.[3] This gives Beijing immense leverage over the global clean energy supply chain.

This concentration creates profound vulnerabilities for investors and for countries seeking to secure their energy transitions. The risks are manifold and include resource nationalism, where governments unilaterally change the rules to capture more value, such as the implementation of higher mining taxes in Chile and Peru or Indonesia’s ban on the export of unprocessed nickel ore to force domestic value addition. [30] More severe risks include sudden government intervention, expropriation of assets, or the revocation of licenses, particularly in jurisdictions with weak rule of law or high levels of political instability. [18]

Investors are now forced to treat geopolitics as a top-tier risk category. A 2024 survey of mining executives found that factors primarily driven by geopolitics were identified as the main trend driving activity in the sector. [29] Private equity firms are explicitly incorporating assessments of their portfolio companies’ exposure to cross-border value chain disruptions and the actions of governments in “strategic sectors” into their due diligence processes. [31] The risk is so tangible that some Western miners have even proposed a dual-pricing system for nickel, creating a “green premium” to differentiate material produced in stable, high-ESG jurisdictions from the flood of Chinese-backed supply from Indonesia. [32] This geopolitical risk factor can neutralise a project’s economic viability, regardless of its technical merits, and acts as a powerful deterrent to investment in many of the world’s most resource-rich regions.

3.4 The ESG Mandate: From Checkbox to Core Risk

In parallel with the rise of geopolitical risk, Environmental, Social, and Governance (ESG) considerations have evolved from a “soft” corporate social responsibility issue into a hard, financial risk and a primary, non-negotiable determinant of project viability. Failure to meet increasingly stringent ESG standards can act as a direct barrier to investment, block access to high-value markets, and ultimately kill a project. [33, 34]

For mining companies, capital itself has become the number one business risk, a ranking that directly reflects the immense pressure to fund growth while simultaneously satisfying the escalating demands of investors, regulators, and communities on ESG performance. [12] The key dimensions of this risk include:

- The “Social License to Operate”: Beyond formal government permits, securing and maintaining a “social license”, the ongoing acceptance and approval of a project by local communities and other stakeholders, is often the single greatest challenge. [6] Conflicts are rampant, particularly in resource-rich regions like Latin America, where disputes over water rights, environmental degradation, and the treatment of indigenous communities are common. [33, 34] Mining is a water-intensive industry, and the risk of contaminating local water supplies is a frequent point of contention. Failure to secure this social license can lead to years of delays, legal challenges, protests, and, in the most extreme cases, project cancellations, as seen with the First Quantum copper mine contract in Panama. [34]

- Investor and Regulatory Scrutiny: The investor community is now intensely focused on ESG metrics. Issues such as tailings and waste management, biodiversity impacts, and water stewardship are under a microscope. [12] There is often a significant gap between the local environmental regulations in developing mining jurisdictions and the much more demanding international standards expected by global financiers and the downstream companies they supply. [33, 34] A project that only meets local standards may be deemed un-investable by a PE fund or an automaker with global ESG commitments.

This evolution of ESG from a reputational issue to a core financial risk has profound implications. A project with poor ESG credentials will struggle to obtain financing from reputable institutions, secure insurance, or sign offtake agreements with major Western brands who are themselves under pressure to ensure their supply chains are clean and ethically sourced. The social license is no longer just about the right to dig; it has become about the right to sell into high-value, high-standard markets. This transforms ESG performance from a mere cost center into a critical source of competitive advantage and a vital component of de-risking a project for the entire capital stack.

Table 4: The Compounding Risk Matrix for Private Capital in Mining. This matrix summarises the primary barriers to investment and highlights their interconnected, self-reinforcing nature. Compiled from various sources. [6, 11, 12, 13, 17, 18, 33, 34]

Section 4: Forging the Future: Innovative Models for Financing the Transition

The formidable array of risks confronting the mining sector demands a commensurate level of innovation in how projects are financed and de-risked. The traditional, siloed model of a mining company seeking standalone financing is proving insufficient to unlock the trillions of dollars in capital required for the energy transition. In its place, a new, more collaborative and sophisticated financial architecture is emerging out of necessity. This new paradigm is built on three pillars: deep strategic partnerships that vertically integrate the supply chain, proactive government intervention that reshapes the risk-return calculus, and the deployment of novel, blended financial structures that allocate risk more efficiently. These models are not theoretical; they are being actively deployed to forge the mineral backbone of the future energy economy.

4.1 De-Risking the Deal: Strategic Partnerships and Offtake Agreements

The single most powerful de-risking mechanism to emerge in the critical minerals space is the trend of vertical partnership, where downstream consumers, primarily automotive and battery manufacturers, become direct upstream financiers and partners. This strategic alignment fundamentally changes the risk profile of a new mining project, moving it from a purely speculative venture to a strategic industrial necessity.

Historically, miners sold their products to a fragmented base of traders and industrial consumers. Today, the existential dependence of the EV and battery industries on a secure supply of lithium, nickel, cobalt, and graphite has compelled them to move upstream. [35] By establishing binding, long-term offtake agreements, these downstream companies can secure the future supply of their most critical inputs, thereby reducing their own exposure to crippling price volatility and geopolitical supply disruptions. [35]

For the mining company, these agreements are transformative. A “take-or-pay” commitment from a creditworthy automaker to purchase a guaranteed volume of future production at a pre-agreed price formula provides a predictable revenue stream. This guaranteed revenue is instrumental in obtaining project financing from banks and other investors, as it effectively collateralises the project and makes it dramatically more “bankable”. [35] These partnerships often go beyond simple purchase agreements to include direct equity investments, advance payments, and joint venture structures, further cementing the alignment of interests.

Real-world examples of this new paradigm are becoming increasingly common:

- Case Study: Volkswagen & Patriot Battery Metals: In a landmark deal, Volkswagen’s battery company, PowerCo, made a US$48 million equity investment for a 9.9% stake in Canadian lithium developer Patriot Battery Metals. Crucially, the deal was coupled with a binding 10-year offtake agreement for 100,000 tonnes per year of lithium concentrate from Patriot’s project in Quebec. This was Volkswagen’s first direct investment in the lithium supply chain, an explicit strategic move to de-risk the raw material supply for its future battery cell factories in Europe and North America. [25]

- Case Study: Lucid & the MINAC Collaborative: U.S. EV manufacturer Lucid Motors has taken a collaborative approach, spearheading the formation of the Minerals for National Automotive Competitiveness (MINAC) initiative. This collaborative brings Lucid together with a select group of U.S. based mineral developers, including Graphite One and Electric Metals. Lucid has signed offtake agreements for natural and synthetic graphite and other battery materials with the explicit goal of fostering a secure, domestic U.S. automotive supply chain and reducing reliance on foreign sources. [24, 36, 37]

- Other Major Automakers: This trend extends across the industry. General Motors has invested in a project to extract lithium from California’s Salton Sea. BMW has provided a US$15 million advance payment to a lithium project as part of its offtake deal. Mercedes-Benz and Ford have similarly entered into agreements with lithium developers in Canada to secure their future needs. [35]

This shift represents a fundamental change in the financing model from speculative to strategic. The involvement of a major downstream partner provides a powerful validation of a project’s technical and commercial viability, mitigating market and price risk and thereby unlocking access to the broader pool of capital, including private equity, needed for development.

4.2 The Government as Catalyst: Policy, Subsidies, and Public-Private Funds

Recognising that the security of critical mineral supply chains is a matter of economic and national security, governments in key consumer markets are intervening directly to de-risk private investment. They are moving beyond the role of passive regulator to become active catalysts, using industrial policy, financial incentives, and direct co-investment to create a more favorable environment for domestic and allied mining and processing projects.

This government action is creating a “protected” investment landscape, altering the risk-return calculation for private investors and making projects in allied jurisdictions more attractive than they might be on purely economic grounds. The key mechanisms include:

- Landmark Industrial Policies: The U.S. Inflation Reduction Act (IRA) is a prime example of transformative industrial policy. By tying lucrative consumer tax credits for EVs to stringent sourcing requirements, mandating that a certain percentage of battery minerals be extracted or processed in the United States or a country with which it has a free trade agreement, the IRA creates powerful, policy-driven demand for domestically produced minerals. [38] This effectively creates a premium market for qualifying projects and directs investment flows accordingly. The EU’s Green Deal Industrial Plan and its Critical Raw Materials Act (CRMA) aim to achieve similar goals by setting targets for domestic extraction, processing, and recycling, and by streamlining permitting for designated “Strategic Projects”. [31]

- Direct Funding and Subsidies: Governments are deploying significant public funds to support the development of domestic supply chains. The U.S. government has provided hundreds of millions of dollars in funding through the Defense Production Act to support American and Canadian companies in mining and processing critical minerals. [17] The Department of Energy (DOE) manages numerous programs offering grants and funding for critical mineral R&D, exploration, and commercial-scale demonstration projects. [39, 40, 41, 42] In a similar vein, India is amending its national mining laws to allow a state-managed trust, funded by mining royalties, to finance the acquisition of critical mineral assets overseas, demonstrating a clear state-led strategy to secure resources. [43, 44]

- Public-Private Investment Vehicles: A more direct form of intervention is the creation of co-investment funds. The InfraVia Critical Metals Fund in France is a model for this approach. While managed by a private equity firm, it is anchored by a significant commitment from the French state. Its mandate is to invest alongside private industrial and financial partners in projects along the entire value chain, with the strategic goal of securing offtake contracts for French and European industry. [26] This model allows the government to leverage private sector expertise while using public capital to absorb risk and steer investment toward strategic national objectives.

These government actions are critical enablers for private capital. By providing subsidies, guaranteeing demand, streamlining permitting, and co-investing in projects, governments are systematically reducing the risks that have historically deterred private investors, thereby lowering the hurdle for capital commitment.

4.3 The New Capital Stack: Blended Finance and Novel Structures

The immense capital requirements and complex risk profile of modern mining projects are driving the adoption of more sophisticated and blended financial structures that go beyond simple debt and equity. The traditional, siloed approach to financing is breaking down in favor of a “new capital stack” where different types of capital and financial instruments are layered to allocate risk more efficiently and expand the total pool of available funding. [19]

This blended finance approach integrates various investor segments, public, private, strategic, and impact, into a cohesive structure. [19] It allows for the development of bespoke financial instruments tailored to the specific risk appetites of different investors. Key components of this new capital stack include:

- Alternative Financing Instruments: Methods like metals streaming and royalty financing are gaining significant traction. In a streaming deal, a financier provides upfront capital to a mining company in exchange for the right to purchase a percentage of the mine’s future production at a fixed, low price. This provides the miner with non-dilutive capital for development while giving the financier direct exposure to the commodity. Royalty financing involves selling a percentage of a mine’s future revenue for an upfront payment. While these instruments are powerful tools for raising capital, they also introduce new complexities regarding taxation and revenue transparency for host governments. [45]

- Commodity Trader Financing: Major commodity trading houses like Glencore and Trafigura are playing an increasingly important role as financiers. Leveraging their deep market knowledge and logistics networks, they provide offtake-linked finance products, offering upfront capital to mining and processing projects in exchange for the right to market their future output. [46]

- Convergence of Capital: The new financial landscape is characterised by the convergence of capital from previously disparate sectors. The fusion of technology venture capital with mining, as seen with AI-driven exploration companies, brings a new risk appetite and technical approach to the earliest, highest-risk stage of the value chain. [16] This convergence is reshaping how projects are identified, de-risked, and ultimately presented to later-stage investors like private equity funds.

This evolution towards a more integrated and sophisticated capital stack is a logical response to the compounding risk environment. It allows for risk to be priced and allocated more precisely, with different investors and instruments participating at the stages where their capital and expertise can be most effective. This ultimately increases the overall resilience and bankability of projects, expanding the total quantum of capital available to meet the energy transition’s mineral needs.

4.4 Conclusion and Strategic Recommendations

The evidence overwhelmingly indicates that the private finance world, including the private equity sector, can and is beginning to mobilise the capital necessary to fund the new mines for the energy transition. However, it is not doing so through traditional, standalone investment models. The sheer scale of the capital requirement, combined with the formidable and interconnected risks of mining, has rendered the old ways insufficient. A new, collaborative ecosystem is emerging out of necessity, one that is capable of de-risking projects to a degree that makes them investable for a broader range of private capital.

The core conclusion of this analysis is that the funding gap will be bridged not by a single source of capital, but by a multi-stakeholder de-risking effort. This effort is being led by strategic downstream partners, primarily automakers, whose need for supply security has made them key financing partners. It is being catalysed by proactive government industrial policies that create more predictable and protected investment environments. And it is being executed through a new capital stack of blended finance that efficiently allocates risk among specialist PE funds, generalist climate funds, public entities, and other sources of capital. Private equity’s role within this ecosystem is crucial and adaptive. It is evolving from a potential lead sponsor to a sophisticated intermediary partner, bringing financial and technical expertise to bear within a de-risked framework created by others.

Based on this analysis, the following strategic recommendations are proposed:

For Private Equity Investors:

- Embrace Partnership: Shift from a strategy of solo ventures to one of deep collaboration. Actively seek partnerships with strategic downstream offtakers and government financing agencies early in the due diligence process to de-risk projects from the outset.

- Develop Specialised, Long-Duration Funds: Recognise the structural mismatch between standard fund life and mine timelines. Develop specialised funds with longer investment horizons (15+ years) or strategies that focus on specific, shorter-duration phases of the project lifecycle (e.g. late-stage development, expansion).

- Build Deep Technical and ESG Expertise: To be a credible partner in the new capital stack, PE firms must possess or acquire deep in-house expertise in geology, mine engineering, and, critically, ESG. Demonstrable excellence in ESG is no longer optional; it is a prerequisite for attracting premium capital and securing market access.

- Price Geopolitical Risk: Geopolitical risk must be treated as a core, quantifiable component of due diligence, not an externality. Investment strategies should prioritise projects in stable, allied jurisdictions that benefit from supportive industrial policies.

For Mining Companies:

- Seek Strategic Partnerships Early: Move beyond traditional customer-supplier relationships. The pursuit of a strategic partnership with a major downstream offtaker should be a primary objective from the earliest stages of project development, not an afterthought.

- Monetise ESG Excellence: Frame demonstrable, best-in-class ESG performance not as a cost center, but as a core part of the project’s value proposition. High ESG standards can unlock access to premium capital, lower the cost of financing, and de-risk operations by securing the social license to operate.

- Be Flexible on Capital Structure: Be prepared to engage with a variety of financing partners and instruments, including streaming, royalties, and joint ventures. A flexible approach to building the capital stack will be essential for success.

For Policymakers:

- Strengthen and Sustain Industrial Policy: Continue to use targeted industrial policies like the IRA and CRMA to de-risk private investment in domestic and allied supply chains. Policy stability and predictability are critical for attracting long-term capital.

- Streamline Permitting for High-Standard Projects: The long permitting timeline is a major deterrent to investment. Governments should create clear, efficient, and predictable permitting pathways for projects that demonstrate the highest ESG standards, rewarding responsible developers with speed to market.

- Foster International Collaboration: Enhance cooperation among allied consumer nations through frameworks like the IEA’s Critical Minerals Security Programme. [2, 3] Collaborative efforts to improve market transparency, co-invest in strategic projects, and coordinate stockpiling can increase the resilience of global supply chains and reduce volatility.

For more information or to discuss this further please contact Simon Gillibrand