Download the full report here >

Key Takeaways

- Next generation CEOs require adaptability, agility, authentic leadership and strategic vision built on a breadth of knowledge. As a response to the ‘VUCA’ environment, CEOs must adapt business models, change customer expectations, prioritise employee wellbeing, and deliver on ESG issues

- Chairs and boards must prepare proactively for both internal and external CEO succession scenarios, which includes having a vision for where they want the business to be in five years and what kind of leader will take them there. Engaging potential external successors or preparing internal successors takes time

PART 1

Challenges facing CEOs

The rate of change affecting businesses has accelerated dramatically over the last decade. Historically, changes of a disruptive magnitude occurred on a reasonably cyclical basis, and were linear by nature; there would be a solution based on prior experience. Pre 2020, the leadership DNA of CEOs was evolving, with the pace of change being dictated by advances in innovation and customer expectations and slower growth rates since the 2007-2008 financial crisis. However in recent years, disruption has been more constant, and often unprecedented. Savannah Group surveyed 90 chairs and CEOs from FTSE and PE-backed companies on how the traits and skills of business leaders are changing. In the responses to an open question about the fundamental challenges facing CEOs today, several key themes emerged.

Next Generation CEOs

Nearly all companies are having to reflect on whether their strategy is still relevant in this new landscape. Adapting existing business models, therefore, is a critical challenge that CEOs face. The CEOs we surveyed agreed that they must ensure the correct resources, talent and flexibility are in place to support the necessary adaptations to their business model.

Many stressed the need for “adaptability in an uncertain and shifting market”. CEOs must not just identify the long-term impact on the needs of customers and staff, but determine how to leverage changes in a way that provides market differentiation and advantage. Those that do so while remaining true to the vision, mission and values of their organisation will be on a strong footing. Leading boldly through change and uncertainty is impressive, but taking advantage of growth opportunities is not possible without a strong balance sheet.

Authentic Leadership

“Most CEOs we spoke to, regardless of how their company has been impacted since the pandemic, are looking to the future. They have stronger scenario planning than before and should be able to adapt faster to any unwelcome surprises. As part of that, leaders need to help their employees come to terms with the ‘new normal’, including higher levels of stress and mental illness.”

Simon Gough, Managing Partner, Savannah Group

People and talent were a common theme in the challenges highlighted by chairs and CEOs in the survey. Stakeholder management should have a “360-degree” outlook, including boards, investors, banks, staff, customers and suppliers, with an “increased focus on culture and diversity.

| Recurring themes | Emerging themes |

| Greater employee participation | Relevance |

| Increased social awareness | Authenticity, as a business and as individual leaders |

| Leading rather than governing | Sustainability |

| Flexible working and work-life balance. |

However, some CEOs dismissed the notion that leadership must change. “No change – you set a vision, then inspire, motivate and direct.” The reality is somewhere in between, and CEOs should aim at evolution, not revolution, in their approach to leadership.

More than ever, businesses require calm, decisive, agile and compassionate leadership, to “inspire their organisation with a compelling purpose, and have the courage to decisively reset strategy, working practices and culture” opined interviewees. “Next generation CEOs need mental agility, greater innovation, greater presence, improved communication skills and a huge dollop of sound common sense with strong moral principles.”

PART TWO

Striking the Right Balance

“Successful executive leadership requires a balance of strategic and operational skills, built on foundation of diverse experience: a combination of agility to deal effectively with unprecedented challenges and ability to inspire others.”

Chris Donkin, Managing Partner, Savannah Group

Three decades on from when the acronym “VUCA” was first coined by the US military to describe the more volatile, uncertain, complex and ambiguous world left behind at the end of the Cold War, its use is now more regularly applied in a business leadership context. In recent years, virtually every sector has had to deal with unparalleled levels of volatility and uncertainty and accelerating rates of change, driven by the pandemic, war and economic crisis, as well as disruptive new technologies, threats of disintermediation, and the rise of new market players. As a consequence, chief executives are being tested like never before. Some have risen to the challenge; pivoting strategy whilst remaining engaged with the operational challenges, inspiring their organisation, and continuing to communicate effectively in a flexible working environment. Others however, have been found wanting. Using another military analogy, one FTSE chairman described his CEO at the height of the crisis as “missing in action”, lacking the leadership skills and behaviours that distinguish his more successful contemporaries. It’s become increasingly clear that a specific kind of leadership markers and competencies are most helpful in dealing with the challenges facing CEOs today and into the future.

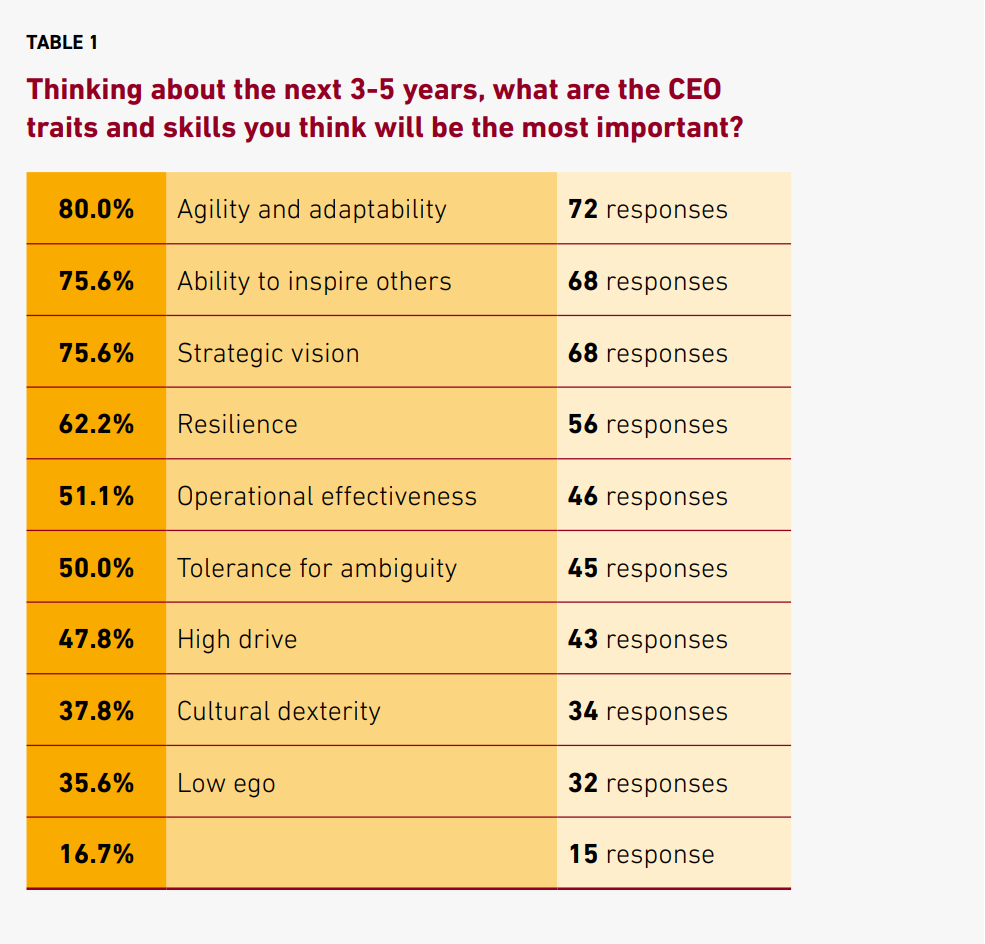

In Savannah Group’s survey, agility and adaptability were ranked highest among the traits and skills that the chairs and CEOs felt will be most important to successful leaders in the next three to five years, cited by 80% of respondents. The ability to inspire others and strategic vision followed, with 75.6% respectively.

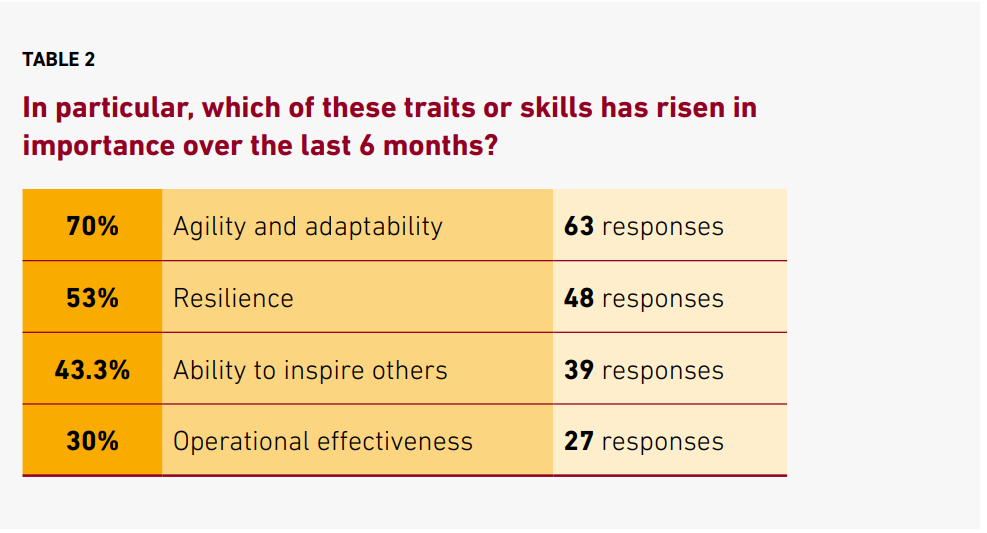

Agility and adaptability were also cited highest among the traits or skills seen to have risen in importance, followed by resilience.

Next Generation Leadership DNA

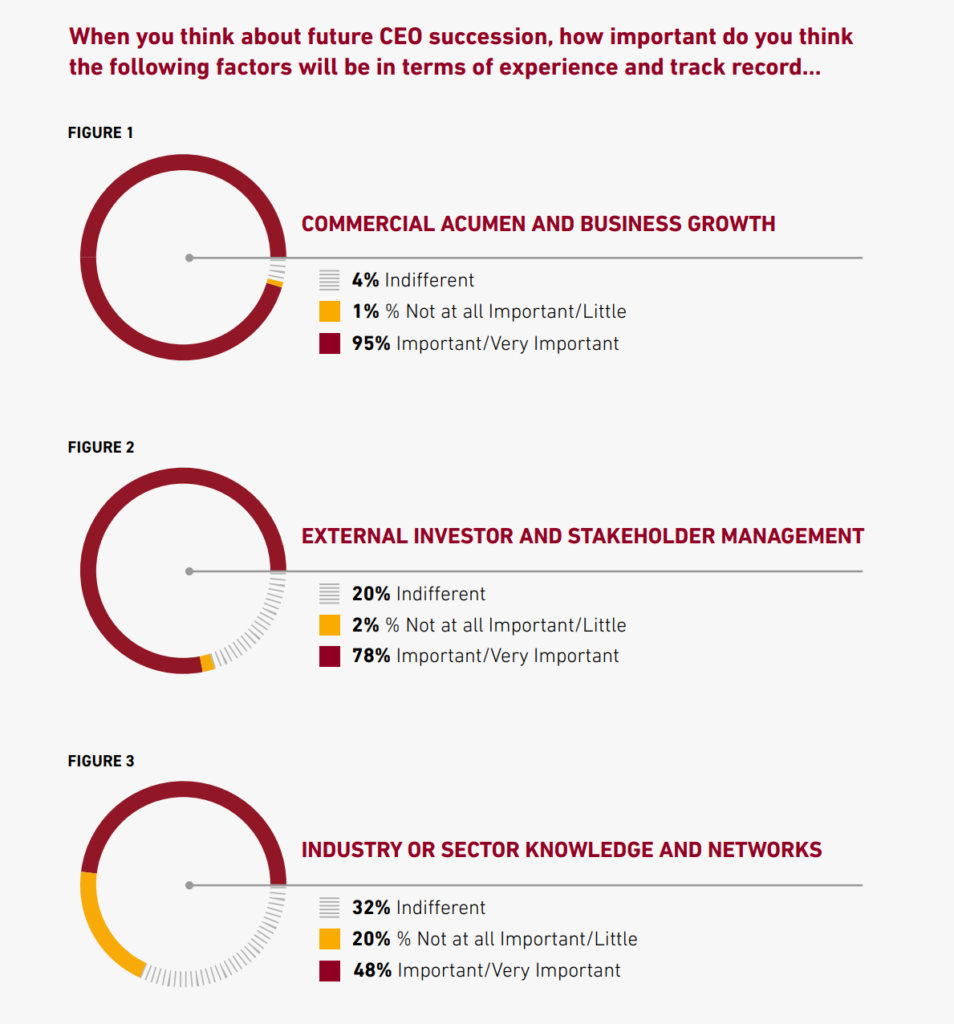

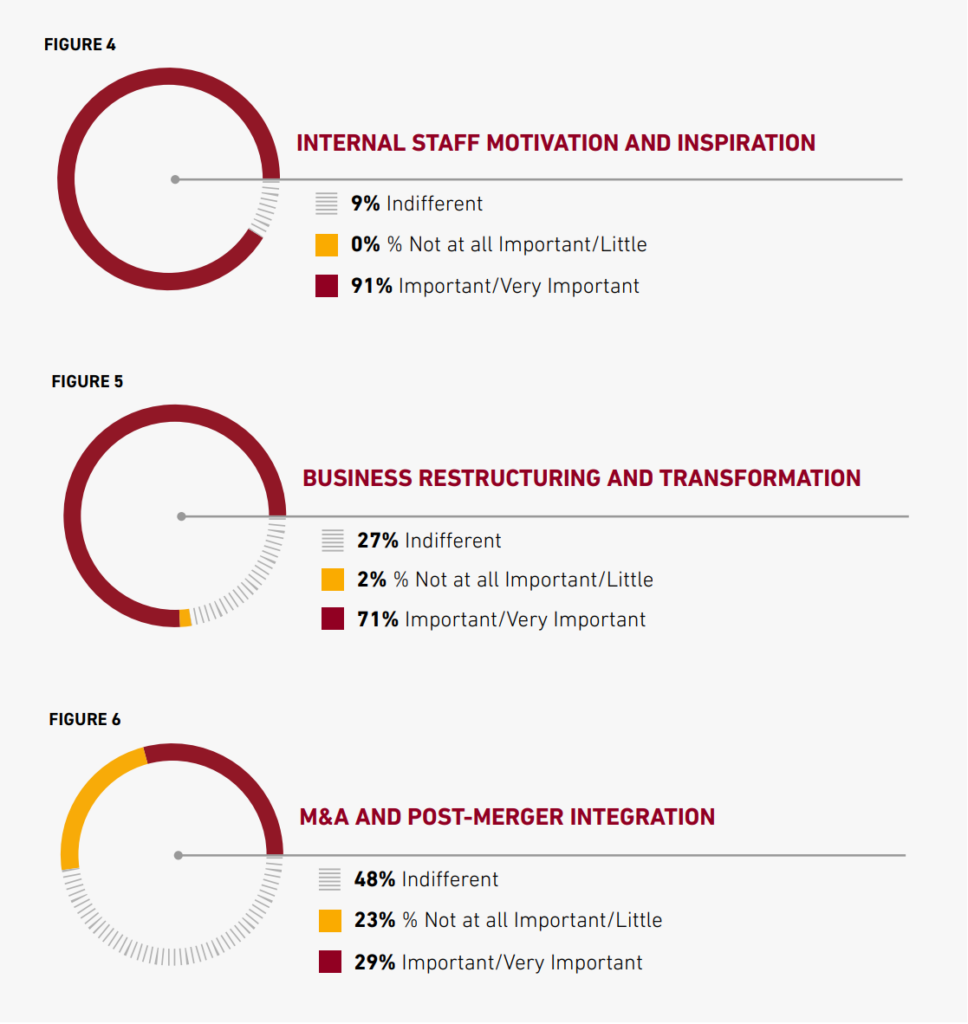

Savannah Group identified three core strands of next generation ‘leadership DNA’ which have emerged as primary indicators of the most successful CEOs. In our survey commercial acumen and business growth were considered important or very important by 94% of respondents, while internal staff motivation and

inspiration were considered important or very important by 90%. Interestingly, fewer than half of the respondents felt that industry or sector knowledge was important or very important going forward.

Going forward, it will be even more important in the context of CEO succession to be able to identify both internal and external candidates. At the same time, agility is not simply the preserve of leadership, but needs to be nurtured throughout the organisation. A key example of this is remote working. While the trend, influenced by the Covid-19 crisis, has accelerated flexible working, now the focus must be on

building strong cultures and high performance across more disparate workforces. Adaptability is a vital ingredient. Rapidly changing business environments require strategically agile leaders, able to quickly adapt to changing situations, with a high degree of cultural sensitivity that makes them equally effective across the global span of their business operations. Agility includes the ability to switch back and forth between the strategic and the operational level, although few CEOs excel at both.

Strategic Vision Built on a Breadth of Knowledge

Different companies, sectors, functions and geographies enhance a CEO’s ability ‘to know what to do when you don’t know what to do’ through aligning the attention of entire leadership teams on a single objective. In the absence of a crisis, however, the number of strategic imperatives at a company can quickly multiply, resulting in a lack of focus. Clearly no business can be run in a perpetual state of crisis, so the CEO has to ensure that clarity of vision is maintained, and that the organisation stays aligned behind a common goal and clear set of objectives. The same applies to their leadership teams. The greater diversity of knowledge and experience surrounding CEOs, the richer the insight they can draw on to deal with unprecedented challenges.

PART THREE

Future CEO Succession

“In the FTSE 100, less than 10% of CEOs are women. With increased pressure for boards to have greater diversity, and with a smaller number of CEO appointments over the last 12 months than in previous year due to economic and political uncertainty, succession planning has never been more important.”

Katrina Cheverton, Chief Executive, Savannah Group

As chairs observe an evolution in the skills and traits they want in a CEO, they also need to ensure they identify the best succession candidates both internally and externally. The CEO appointment is by far the most visible and important in any business. The CEO has the greatest single effect, positively or negatively, on how the company performs in the future, so planning proactively and sensibly for

succession is a crucial process for chairs and boards to devise and execute. There is no standard rule for CEO succession, as each one is different, both contextually and situationally. But what every succession does have in common is a level of risk, so the chair and other board members involved in managing the process must mitigate that risk as best they can.

Typically, that means making a decision between internal versus external hiring. If the company is well-run, has grown its revenue, profit and share price for the last five years, and is highly regarded by investors and City analysts, the risk profile of an internal ‘continuity’ CEO is relatively low. If, however, the business is underperforming, and the outgoing CEO was not positively regarded by stakeholders, then the lesser risk is bringing in a proven external hire who has been successful and highly regarded by investors elsewhere.

However, such thinking is becoming less prevalent, with indirect but transferable knowledge and skillset increasingly valued over direct industry and sector experience, as our survey results show: when a chair or board seeks an external CEO succession, there are further considerations to be weighed in terms of risk

profile. As a rule of thumb, investors will often judge a CEO candidate against three defining factors: what they do (their current role), who they do it for (company and sector) and where they do it (geography).

Diverse Leadership

The recent crises have amplified the risk profile of any CEO succession. It will also likely influence the internal versus external debate that boards have in future. Some businesses previously highly regarded by investors, for example, have struggled immensely, illuminating certain leadership shortcomings during a period of crisis. Accelerating rates of change may also increase the likelihood of boards promoting or hiring CEO candidates from less uniform backgrounds: They can draw on the breadth of their own personal experiences along with that of the people sitting around their management table. It could be argued that the role of the CEO is evolving into something more akin to an executive chair; gathering input from across the leadership team, ensuring the less forthright are heard just as loudly as the outspoken, and debating those views constructively before making a final decision. For this to be effective, the CEO needs to be able to:

- Assemble a diverse leadership team.

- Lead the process of developing vision and strategy by drawing out all of

- that shared knowledge and experience

- Structure the team to manage implementation at an operational level.

How to successfully execute a CEO succession

- First, be clear about where the business is going and where it should be in three to five years. A forward-looking approach from the Boards will inform what kind of experience and skill set they want from a leader. Few commercial organisations can succeed with no senior external appointments, but equally, internal promotion is important for retaining institutional knowledge and building a culture that promotes development.

- Find the right balance between bringing in fresh talent and developing internal executives. This can be a challenge, with many organisations focusing too heavily on the internal process, until they realise their “bench strength” is insufficient, at which point they’re already in a reactive diversity; not just in the well-publicised inclusion sense – gender, race and sexual orientation –, but also including skillset, background and breadth of experience.

- Clearly identify the skills and experience a CEO needs to achieve the business goals. The most successful CEOs are increasingly those who have had broader careers, so greater diversity across the wider executive team is key. A more integrated and holistic view, linked to the goals of the business over the next five years, will render much stronger results

- Accelerate the development of internal succession candidates and overcome any areas of shortfall, while monitoring who in the external market comes closest to the future-focused set of criteria decided by the board. This requires Boards to also clearly identify whether such leadership can be developed from within by nurturing high potential internal talent. Even if they believe they can, they should still supplement that nurturing process by bench-marking internal candidates against the best external talent so they can more proactively plan for both eventualities

Survey Methodology

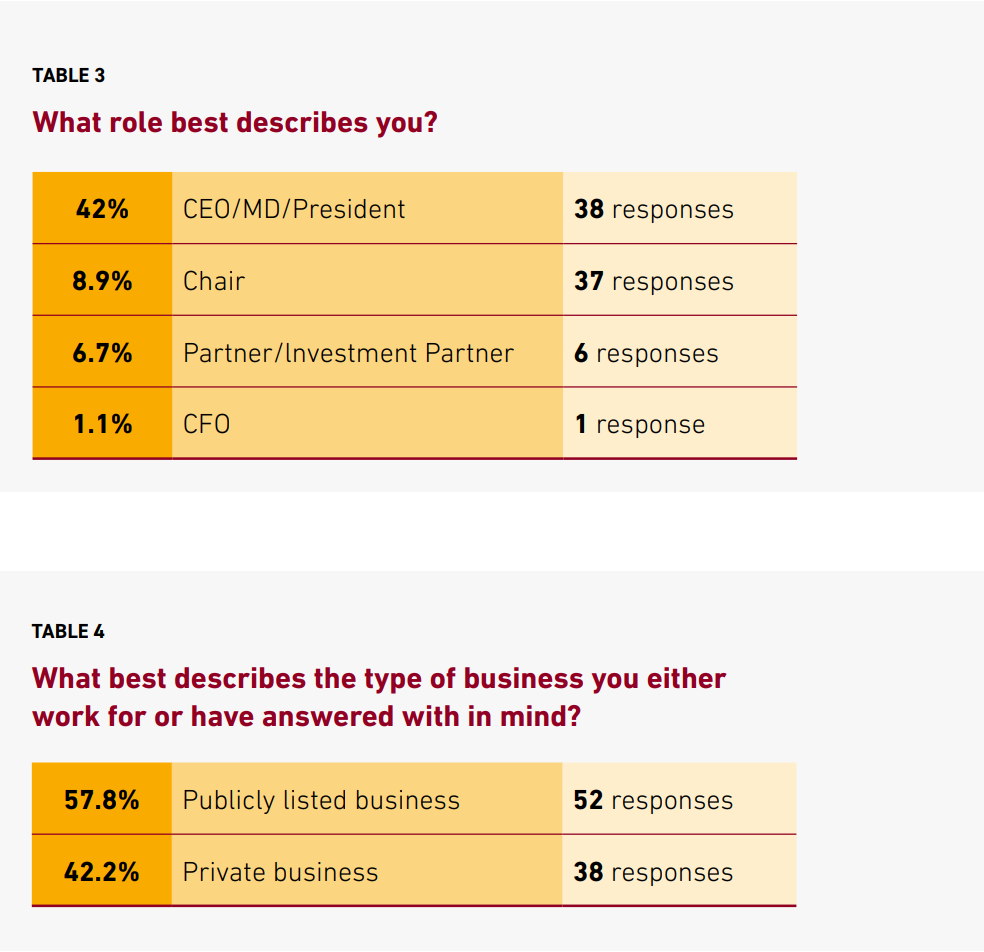

We surveyed 90 chairs and CEOs from FTSE and PE-backed companies.

About Savannah Group’s Board Practice

Governance practices of UK companies are being rightly challenged. Ticking the boxes on “governance” does not protect financial integrity, shareholder returns and broader stakeholder interests. At Savannah Group, we have the proven experience, knowledge and intelligence to advise and assist Chairmen and shareholders in building effective boards and top management teams. To discuss how we can help, please contact one of our Board Practice members.

Contributors