In recent weeks, we’ve seen a marked rise in multinational organisations re-evaluating their global location strategies. From manufacturing and engineering sites to shared service centres and digital delivery hubs, businesses are under increased pressure to reassess where they operate. And at the heart of this new urgency? Tariff turbulence.

The United States government, under its current administration, has been advancing a domestic manufacturing agenda, promoting reshoring and reducing reliance on overseas supply chains. This shift, coupled with rising tariffs on non-US imports and an increasingly volatile trade policy environment, presents significant strategic challenges. Jaguar Land Rover reacted by immediately suspending shipments to the US (which accounts for around a third of sales) while it considers how to mitigate the impact of tariffs.

As duties fluctuate and international trade agreements evolve, the knock-on effects extend beyond logistics and cost structures. For many businesses, these changes will impact talent strategies. Senior leadership teams are increasingly turning to HR and Talent functions to provide insight and foresight into what options they have in this new environment.

Tariffs, Trade Tensions and the Talent Tie-In

As companies consider relocating or expanding operations, the critical question becomes: Where is the best talent located for us – now and for the future? Talent is no longer a peripheral consideration – it’s central to decision-making.

HR and Talent leaders are being asked:

- Which alternative regions offer the specialist talent we need?

- What are the trade-offs between cost, quality, and ease of access?

- How do new markets compare to our current workforce in capability and diversity?

- Can we find leadership talent to sustain long-term growth in a new region?

These are complex strategic questions, and answering them requires robust, location-based talent intelligence.

How Location-Based Talent Analysis is a Critical Advantage

Organisations are demanding data-driven insights to support major location decisions. Comprehensive assessments that combine desk research with real-time market data provide clarity in a turbulent environment.

Key elements typically include:

Workforce Size and Talent Pool Depth: The volume and density of professionals in relevant roles within a location. This includes both active and passive candidates, as well as functional and seniority breakdowns.

Ease to Hire and Market Fluidity: An evaluation of how competitive and accessible a talent pool is:

- Demand-supply ratios (open roles vs available candidates)

- Candidate mobility and openness to change

- Average time-to-hire for key positions

Competitive Landscape: An analysis of other employers targeting similar talent, helping organisations anticipate hiring challenges and benchmark their value propositions.

Accessibility and Infrastructure: Physical and digital infrastructure that enables talent attraction and retention:

- Proximity to international transport links

- Public transit and commute viability

- Office space availability and connectivity

- Broadband speed and mobile coverage

Diversity Metrics: Gender and broader diversity breakdowns within the available talent pool, assessed through public data and representative sampling.

Specialist Skill Concentrations: Availability of niche industry skills or high-demand capabilities such as AI, cyber security, financial risk, or data analytics.

Cost Comparisons and Salary Benchmarks: Evaluating the affordability of local talent:

- Role and level-specific salary ranges

- Social tax obligations and statutory contributions

- Local vs expat compensation norms

Other Critical Considerations When Evaluating Location Strategy

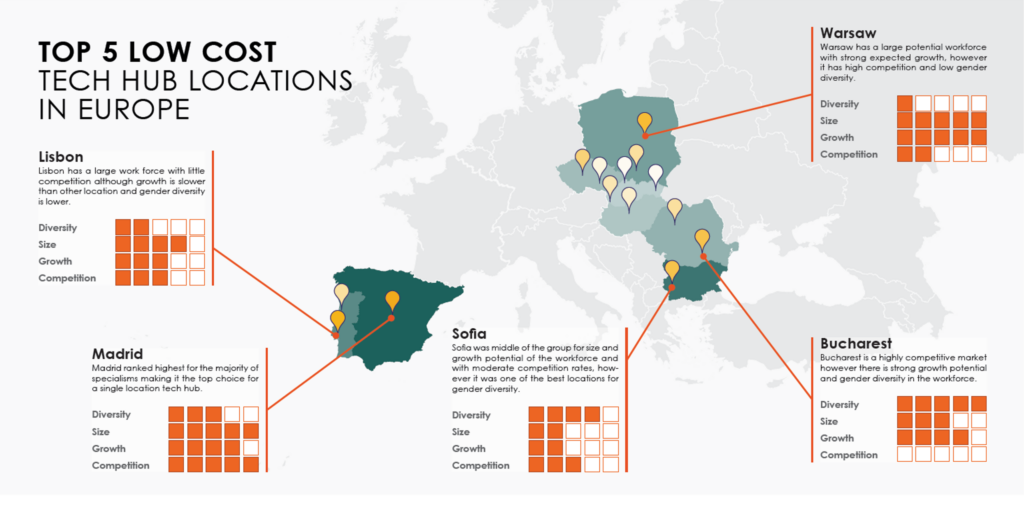

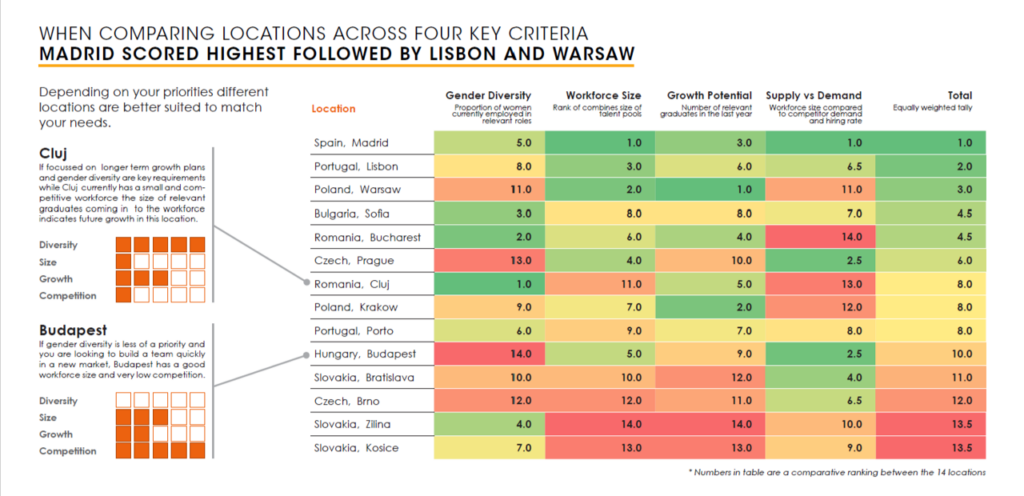

For organisations we work with, typically we use a selection of the above to narrow down from a long list of locations to a smaller list and then do a deep dive to rank a final shortlist of locations in order of attractiveness. While talent availability, quality and cost are highly influencing factors, organisations will also consider:

Real Estate Costs: The cost and availability of commercial property to support growth.

Geopolitical and Regulatory Risk: The level of political stability and regulatory transparency in the region.

Language and Cultural Fit: How well the local culture and language align with business operations.

Education Pipeline and Graduate Output: The quality and volume of graduates in relevant disciplines.

Local Tax Environment: Corporate and employment tax implications that affect operational costs.

Labour Laws and Compliance: The legal landscape governing hiring, firing, and worker protections.

Availability of Support Services: Access to reliable recruitment, legal, and training service providers.

Quality of Life and Relocation Attractiveness: Factors that influence talent relocation, such as safety, schools, and lifestyle.

Time Zone Compatibility: The extent to which working hours overlap with HQ or global teams.

A successful location strategy brings these practical dimensions together, weights the categories that are most important and uses detailed talent mapping and market intelligence to make decisions that are scalable, resilient, and future-proof.

Make Sure to Build Talent Pools Specific to Your Organisation

Data analysis won’t give you reliable insights if the data it is based on isn’t relevant. With Talent Intelligence activities like Location Strategy, it’s crucial that bespoke talent pools are built before the analysis is run. Large scale talent insights platforms will often give an indication of a size of talent pool that is several times larger than the amount of relevant individuals within the market.

Alongside a list of job titles and locations, every organisation will have other criteria which would be insisted on if live recruiting for these roles. Given the objective is to provide the most accurate reflection of what hiring in these markets would look like it’s important to consider these other attributes. For example, there may be certain sectors that it is likely someone would need to have experience in, having worked in organisations of a certain scale, certain requirements for particular roles or varying experience levels. We call this a quality metric and it can fluctuate between 10% and 40% of a talent pool size for a particular role at a specific organisation. These need to be factored in or the organisation risks betting big on a location only to be surprised when the numbers of relevant people is far lower than expected.

Comparing Existing Locations with New Opportunities

As businesses reassess their location strategies, this is done through the lens of current locations compared to potential alternatives across a consistent set of criteria.

This kind of location benchmarking supports more confident decisions when considering expansion, consolidation, or transformation. It ensures leadership teams weigh the full picture—talent, cost, scalability, and risk—before committing to change.

The Turbulence Isn’t Going Anywhere

While tariffs may rise or fall with shifting political agendas, the underlying truth is clear: uncertainty is here to stay. Businesses that thrive in this environment are not simply reactive, they plan for resilience.

Embedding talent intelligence into wider business planning allows companies to adapt confidently to trade volatility, economic shifts, and organisational transformation.

Whether assessing Eastern Europe for engineering, Southeast Asia for customer service, or nearshoring in Latin America, every location decision must now be grounded in data, context, and foresight.

For help to evaluate the impact of tariff changes and other contextual shifts on your talent strategy, please contact us.