When executing business strategy, uncertainty increases risk. In the last five years, there has been a marked shift in the techniques, sophistication and speed with which an organisation can understand the increasingly dynamic talent landscape. This capability is called talent intelligence; a method of gathering, organising, analysing and presenting data on the external talent market. In our previous article we provided an overview on what talent intelligence is and why more leaders are using it. Here we examine four examples of how talent intelligence reduces uncertainty and risk gleaned from our experience of delivering close to a hundred projects.

1. Talent mapping for skills and capabilities

Organisations investing in growth must acquire the necessary skills to ensure success. Growth strategies include digitisation, diversification of products and services, entering new locations or markets and decarbonisation, or a focus on renewable energy. Additionally, some sectors require the flexibility to deploy specialised teams across different locations worldwide at short notice.

To navigate these shifts effectively, businesses often begin by assessing their existing workforce to identify individuals possessing the required skills. However, in many cases, internal resources do not suffice, prompting the need to acquire additional talent externally. The availability, diversity, and competitiveness of the skills needed influence the speed at which they can be acquired, thus directly impacting the realisation of strategic objectives.

Talent mapping has emerged as a crucial tool for companies aiming to access the skills and capabilities necessary for achieving their goals successfully.

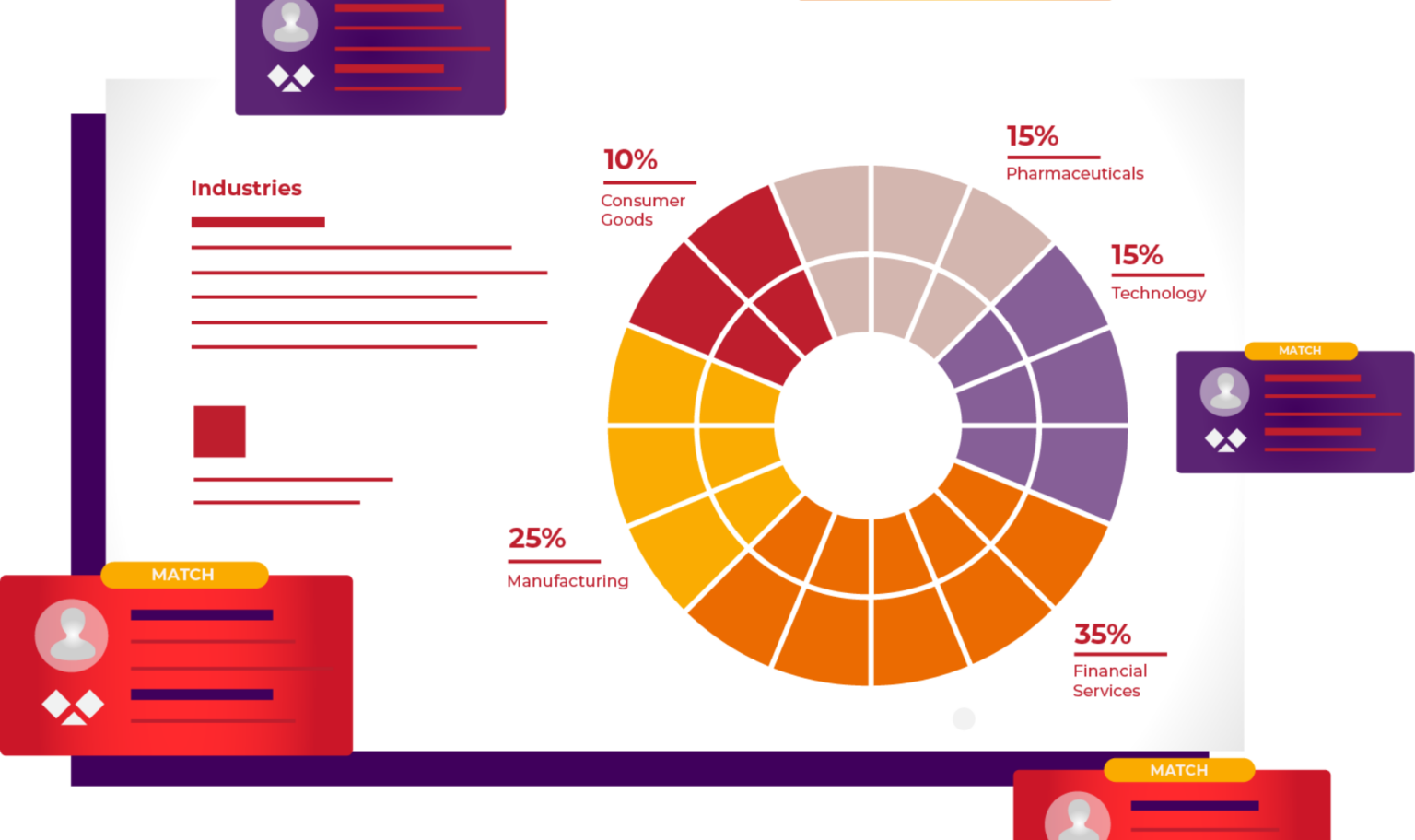

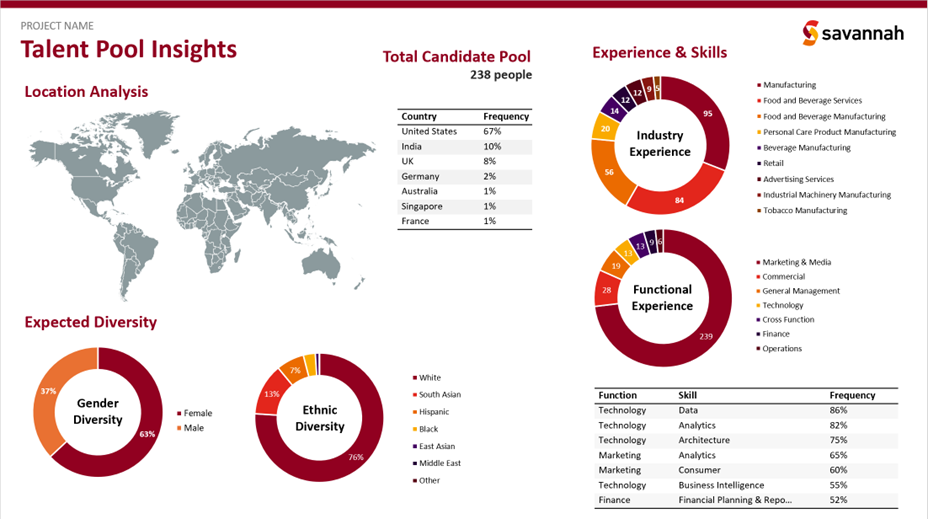

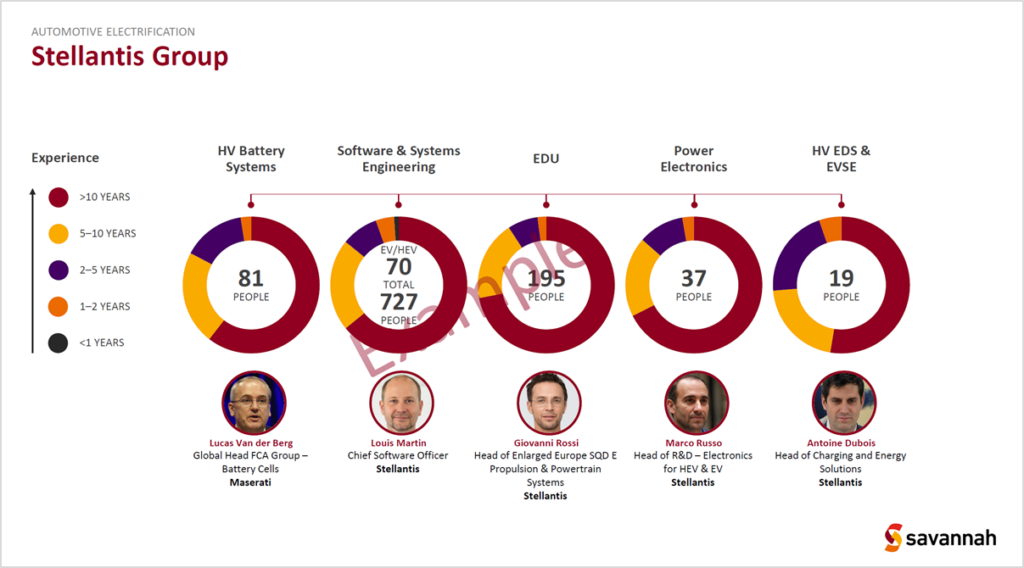

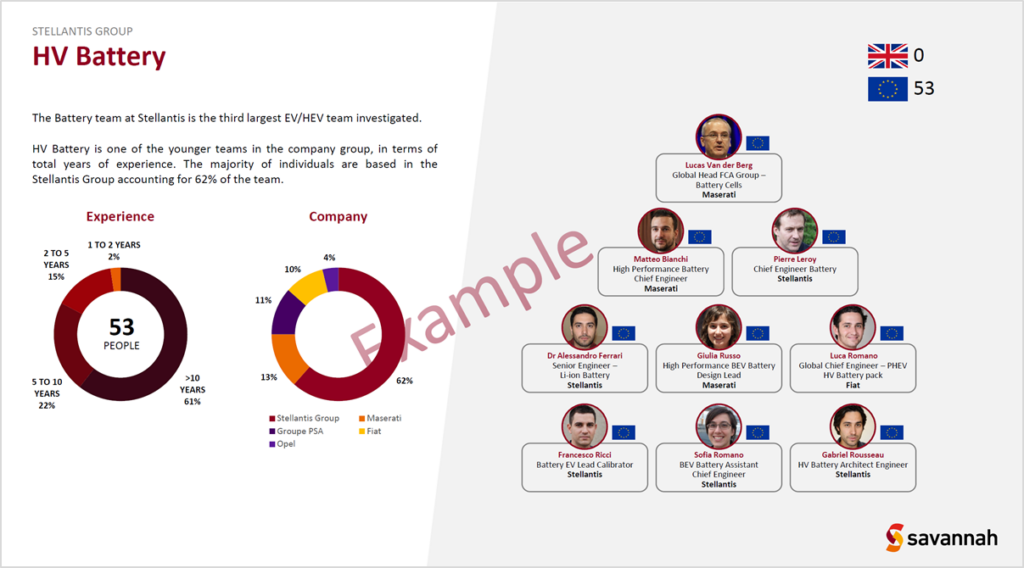

Figure 1: Leadership talent pool data example. Data dashboards like this indicate talent pool distribution, skills, expected diversity and more.

When to use talent mapping?

- Acquisition of a particular skill-set needs to be scaled up

- Talent pool size, distribution, cost and mobility needs to be understood

- Diversity needs to be increased

2. Succession benchmarking to compare internal succession options with external candidates

All good businesses create succession plans for leadership positions and key roles. However, sometimes planned or unexpected changes mean that succession plans need to evolve or accelerate. When the change is not immediate (where the solution would often be an interim appointment) a business needs to decide quickly on whether to promote internally or hire from outside.

In these scenarios, succession benchmarking is a valuable tool. By turning the profile of an incumbent or successor into a series of technical markers, relevant potential candidates are measured objectively against these markers (markers include skills, size of remit, industries/companies worked in and more). Presentation of profiles in this way enables a more objective discussion about the experiences and capabilities of individuals outside the organisation and how this compares to internal candidates.

Succession benchmarking involves building a relevant pool of individuals that meet a specific criteria and using data analysis to objectively compare them to an incumbent or internal succession options. Presentation in these reports would typically include the career profiles of relevant individuals and data points for comparison including fit against the key criteria for the role, skills, experiences and ranking. The outcome from the report is a recommendation of profiles that are the strongest examples of external options versus the internal successor.

Figure 2: Candidate comparison example. In this example the comparison is based on both subjective scored competencies (fit to brief) and technical markets (specialisms) from the variety of roles they have held throughout their career. Predicted Mobility and a Diversity of Experience plot help indicate how open this person would be to an approach and the breadth of experiences they have been exposed to throughout their career vs a benchmark.

When to use succession planning with external benchmarking:

- The organisation has an ambitious transformation strategy including new business models, services/products. The candidate(s) selected to succeed C-suite positions were chosen for a different business profile and now need to be evaluated against potential candidates with experience more aligned with the new direction

- A preferred candidate has been nominated for a senior position. From a good governance perspective, the management team/board wish to compare that individual to other available options

- An incumbent is moving on or needing to be replaced. The external market needs to be validated as part of replacing them

- As part of annual leadership team succession reviews

- When a succession plan needs to be accelerated and there are questions on the successors ability to step up so soon

3. Location analysis to evaluate options on where to base new teams or access the best quality talent

Businesses building or expanding teams typically now have more options on where to locate that team. The decision of where to locate certain capabilities has an impact on ease of hiring those skills and cost.

From a talent perspective, the decision typically assesses six things: talent pool size, quality, competitiveness of the market, growth potential, diversity and cost. In addition to these considerations, businesses might also analyse real estate costs, size of graduate market, geo-political risks and quality of life in these locations.

Organisations deciding where to build their new technology hub or shared service centre; or those comparing US, European and South East Asia as talent pool sources are some examples of where location analysis can be usefully deployed.

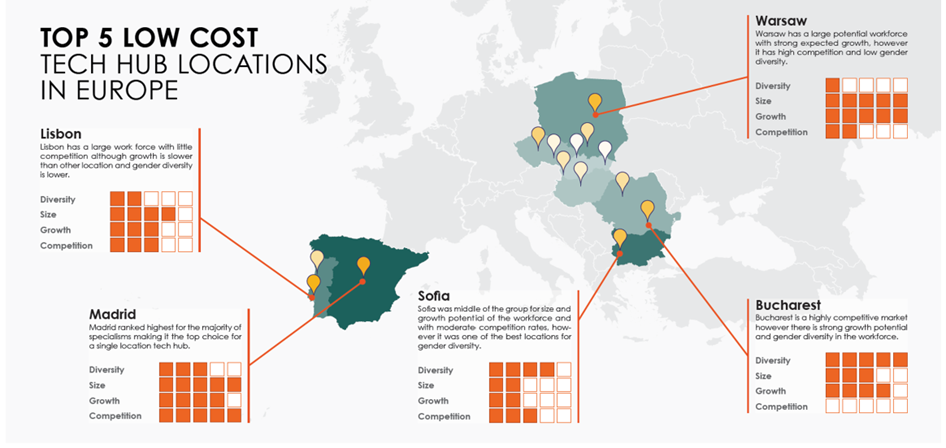

Location analysis can uncover significant talent investment savings while not compromising on quality. For example, we identified a $1,000,000 difference between lowest and highest cost locations for a 10-person team build.

Projects involve comparing and contrasting cities, countries and regions to each other to understand talent data on specific populations relevant to future talent acquisition. The outcome is usually a decision on which locations in which to focus talent acquisition efforts which informs both skills acquisition and location strategy.

Figure 3: Aggregated scores by location to guide a business on where to build a tech hub in Europe

When to use location analysis:

- Multinational companies with numerous options for where to base a new team

- Comparing the skills and experience of an existing function or team to other international markets

- Creating the business case for new location or team location move

4. Analysis to understand the team size, structure and capabilities contributing to strong competitor performance

Understanding how category leading businesses are structured, where they hire from and the skills and capabilities they have is an extremely powerful tool for benchmarking and planning future skills development.

Competitor analysis is also a valuable exercise for investors and funds who are assessing leadership capability in relation to their value creation hypothesis to identify gaps.

Competitor analysis involves analysing the leadership team, functional capabilities or specific individuals within competitors and companies of interest. Reports typically include: organisational charts, tenure, highlighting of profiles of interest, company data, talent sources, size of functions and skills. If it is a team-based assessment, outputs plot individual team members based on experience and skills. The outcome can be to inform a future function or capability buildout. Or to identify skills within a team with low coverage that are necessary to acquire.

Examples include:

- Competitor intel on new hires and team structure

- Assessing flight risk at a rival company following anticipated change

- Benchmarking leadership team capabilities of an asset/operating company vs others in the market

When to use it?

- Building new capabilities within a function

- Creating a new division within a company

- Considering the organisation design and job architecture of a function

- To gain competitive advantage in hiring

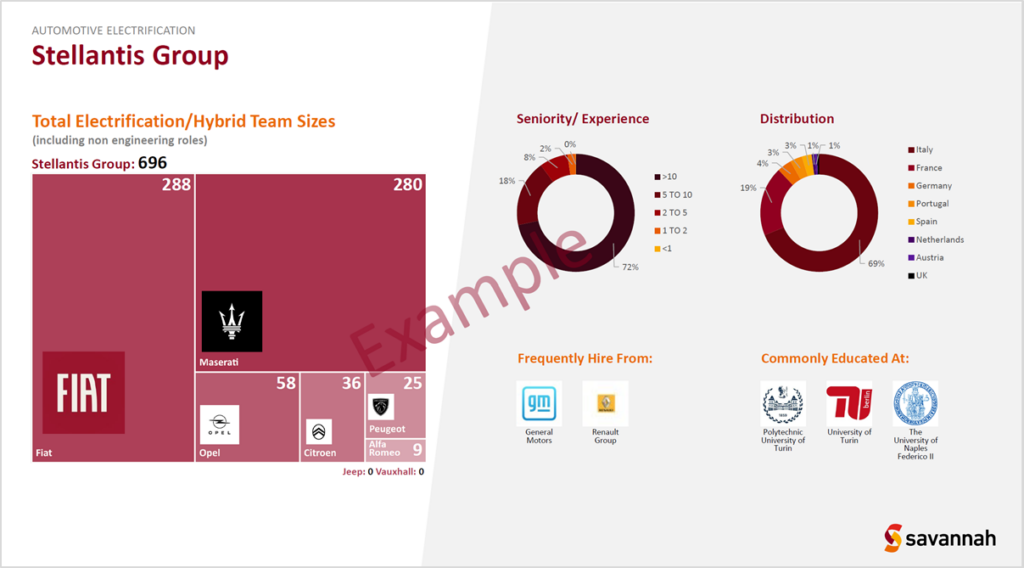

Figure 4: An overview of a company and its subsidiary structure with a focus on a particular type of talent (in this case electrification).

Other popular views include a breakdown of team sizes, experience and leadership

In Conclusion

Leading organisations are increasingly using data and insight to inform decision making. Talent Intelligence continues to evolve as a tool for forward-thinking leaders. With sophistication and accuracy increasing by the month, many talent strategy decisions would benefit from rigorous data and insight as inputs. Many senior recruitment investments should start with smart data and insight to ensure that the brief as defined will lead to the right outcome. Talent Intelligence is fast becoming a core component of best-in-class talent acquisition; surfacing relevant data quickly, aligning key stakeholders from across the business and helping internal resources prioritise on areas likely to yield the most success.

More Information on Savannah’s Talent Intelligence Solutions here: https://savannah-group.com/what-we-do/services/talent-intelligence/