Download the full report here >

Study objectives

In the context of a difficult hiring environment for technology talent, we set out to answer a series of critical questions.

- What is the availability, diversity and cost of tech talent across Europe?

- How do traditional tech hubs compare to cheaper alternatives and which locations show the most promise?

- Are there pockets of technology specialisms in certain locations?

Download full report here.

Demand drivers

Top tech talent is still in high demand

Despite tech companies around the world laying off 160k+ employees in 2022, demand remains high as businesses across sectors seek to build up their tech capabilities. In a survey of tech leaders at the end of 2022, 39% felt acquiring talent had become harder in the previous 12 months.

Tech salaries are increasing fast, pushing organisations to look for lower cost locations

Salaries in the CEE region can be three times lower than those in the UK, and the quality of the workforce remains high. Moldova, Romania, Poland and Ukraine ranked in the top 10 countries in the world to find developers in 2022, with Sofia, Bulgaria also a top 10 city.

Growing acceptance of remote working has created new options for building teams

Location has become less of a limiting factor post-pandemic, meaning organisations can tap into new locations with large, capable workforces and lower competition for talent.

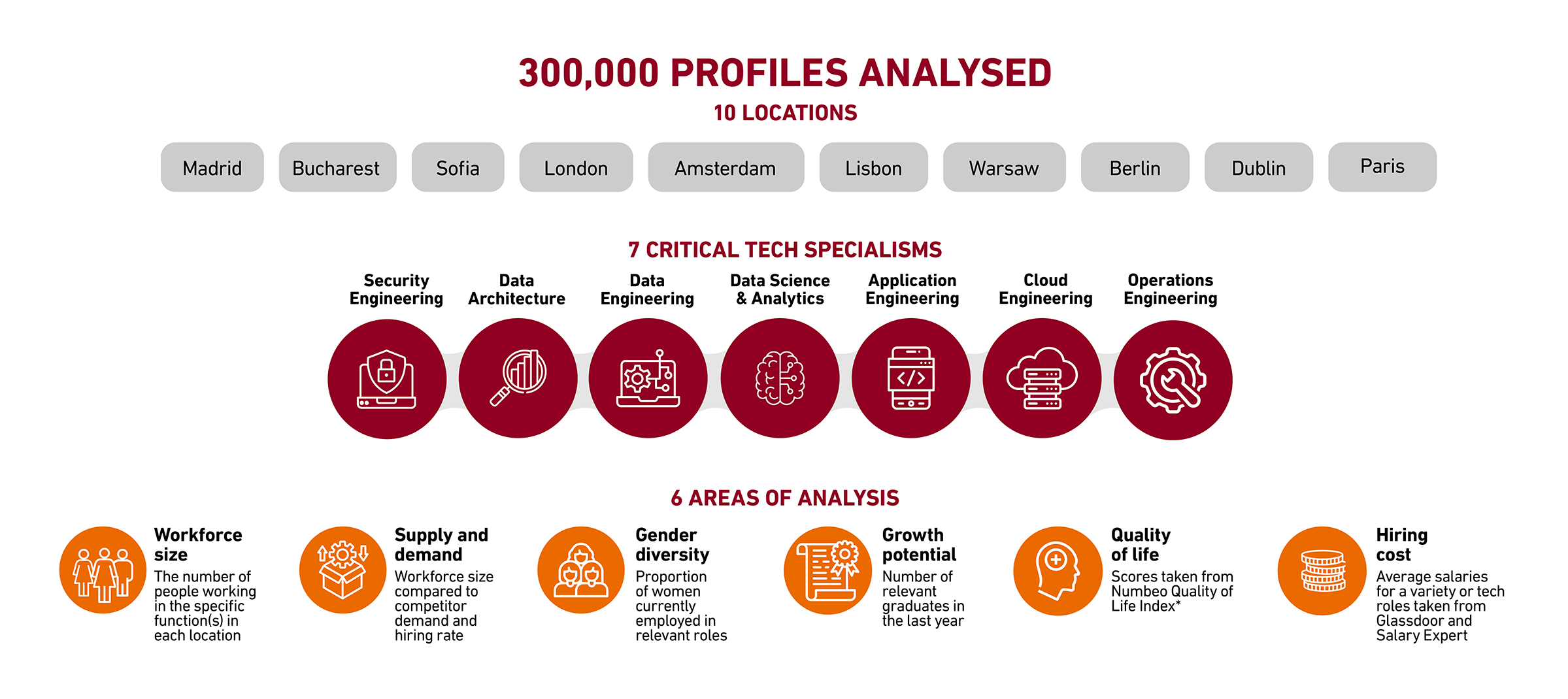

The study in a nutshell

We have carried out an assessment in order to understand where to source and base technology talent across Europe.

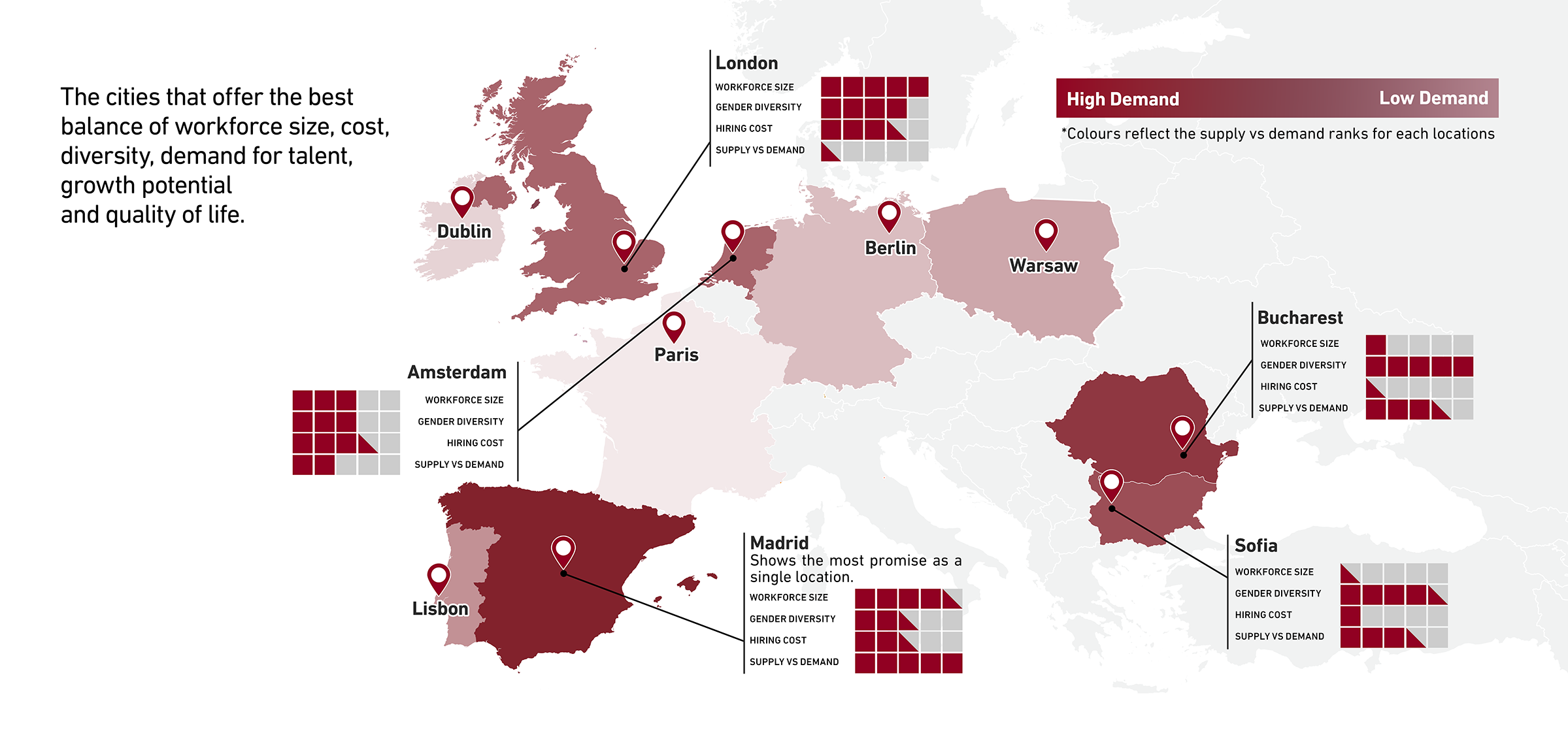

Best locations for tech talent 2023

Locations are ranked according to their overall relative strength.

- Madrid ranks highest overall. It has a large workforce and low competition as well as ranking highly for quality of life. It also ranked consistently highly across all seven tech specialisms. Although not the cheapest of the locations analysed, Madrid still offers a significant cost saving.

- Bucharest and Sofia also show significant potential as alternatives to the more traditional locations. Despite having smaller talent pools, they both have good growth potential and lower levels of competition, as well as being the most diverse locations assessed.

- Paris and Berlin, often listed amongst Europe’s top tech hubs, performed relatively poorly overall, sitting behind all of the alternative locations. Although Paris has a larger talent pool, diversity, growth potential and quality of life are lower.

- Amsterdam falls in the middle of the range and has good growth potential, so could be a good option for longer-term hiring strategies. The high quality of life here also makes it an attractive location for people to live and work, although hiring costs are high.

- According to data from Eurostat, labour costs in Central and Eastern Europe can be as little as 40% of those in the largest Western European economies. In our research we found that the average salary for a data scientist in Bucharest is a third of that in Berlin.

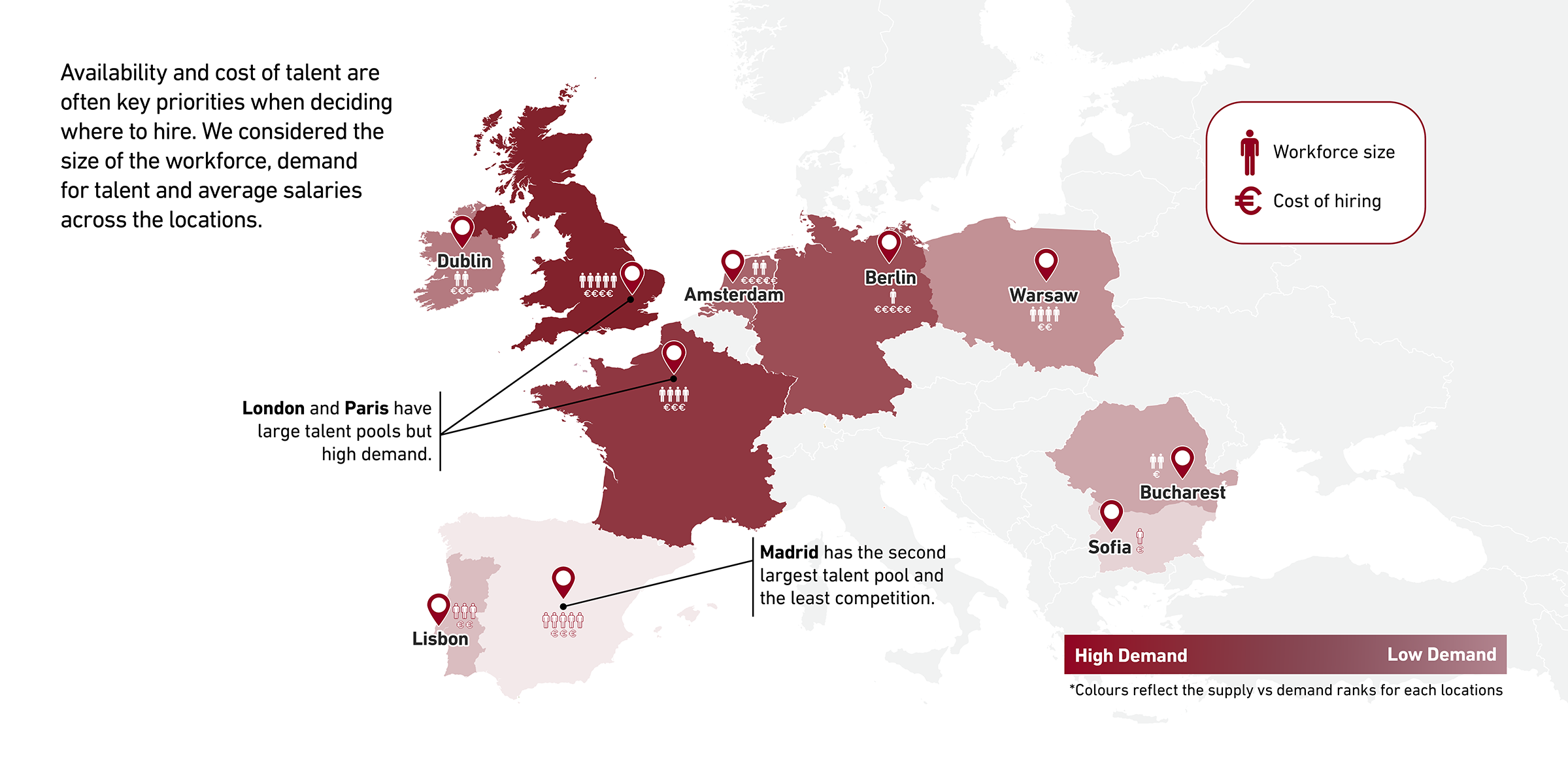

Cost and availability in focus

To understand how easy it is likely to be to hire in a location, we considered the size of the workforce and the demand for that talent.

- Madrid has the second largest talent pool and the least competition as well as offering slightly lower cost than the traditional locations.

- London and Paris have large talent pools but high demand, making them more challenging locations in which to hire.

- Warsaw falls in the middle of the range in terms of talent availability, but the reduced cost of talent here is an advantage, ranking third lowest in our salary assessment. It is also worth noting that “90% of Polish software developers have an intermediate or higher level of English proficiency”, an important factor when building an international team.

- Sofia and Bucharest have small current talent pools but offer low competition and cost, as well as having strong growth potential. They also sit in the Three Seas Region – the 12 EU countries that connect the Black, Baltic and Adriatic seas which includes Romania, Bulgaria and Poland. The region has been highlighted as an area for significant future growth in tech skills.

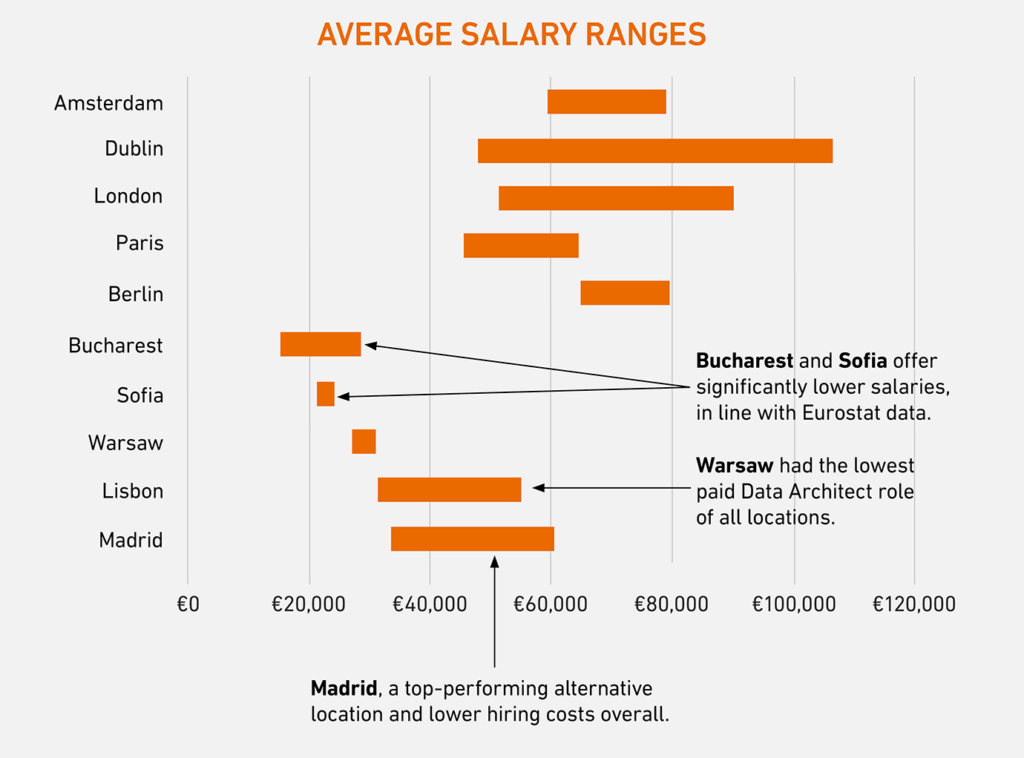

Compensation trends

Cost of hiring is becoming an increasingly significant factor, considering the rising demand for tech capabilities and continued growth of salaries as a consequence.

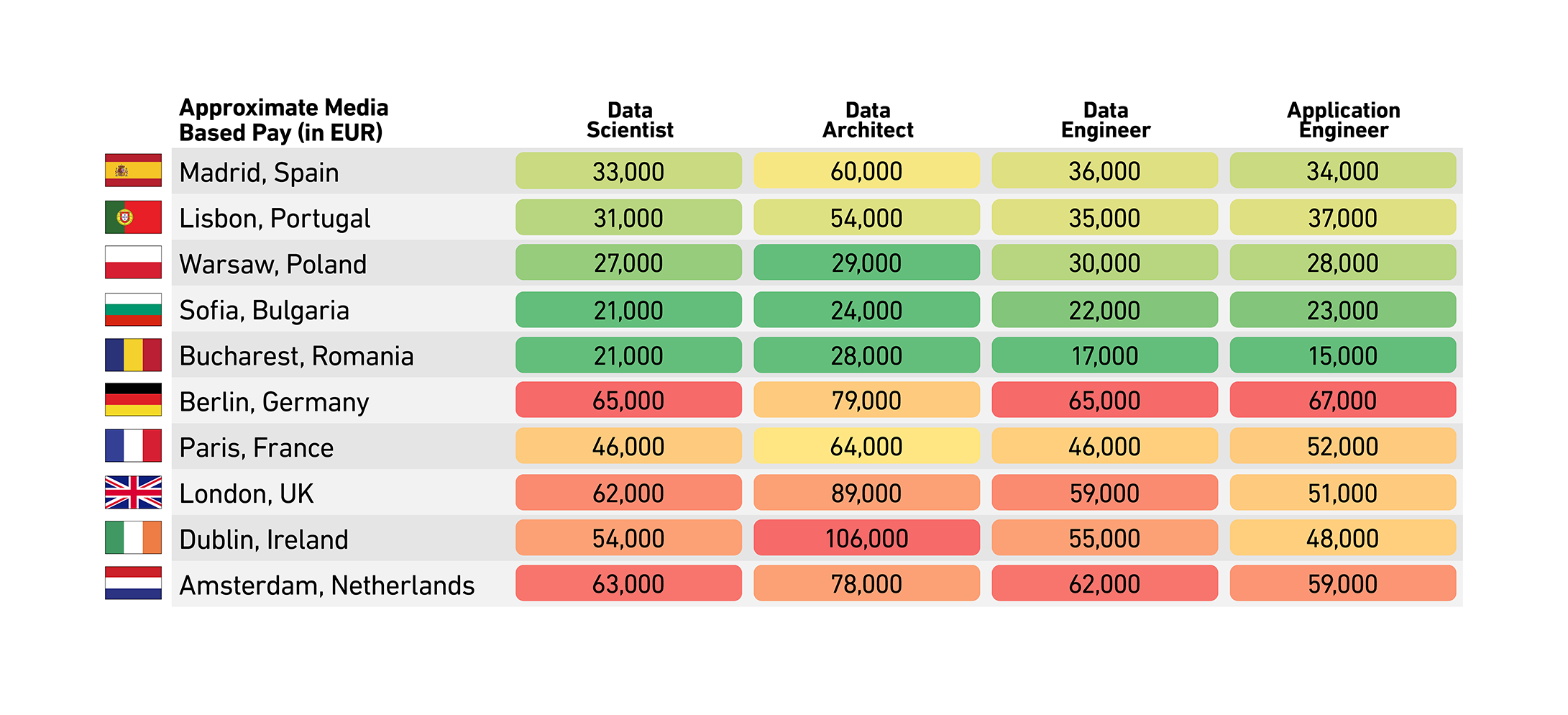

We looked at the average salaries for a variety of roles across the locations to give a sense of the cost saving that could be achieved in the alternative locations.

The eastern European locations offer significantly lower salaries, in line with the data from Eurostat. Madrid, the top-performing location overall, also represents lower hiring costs, albeit falling slightly closer to the traditional locations.

With the exception of Warsaw, Data Architect was the highest paid role in each location. Despite having a wider salary range, Bucharest was the cheapest location overall.

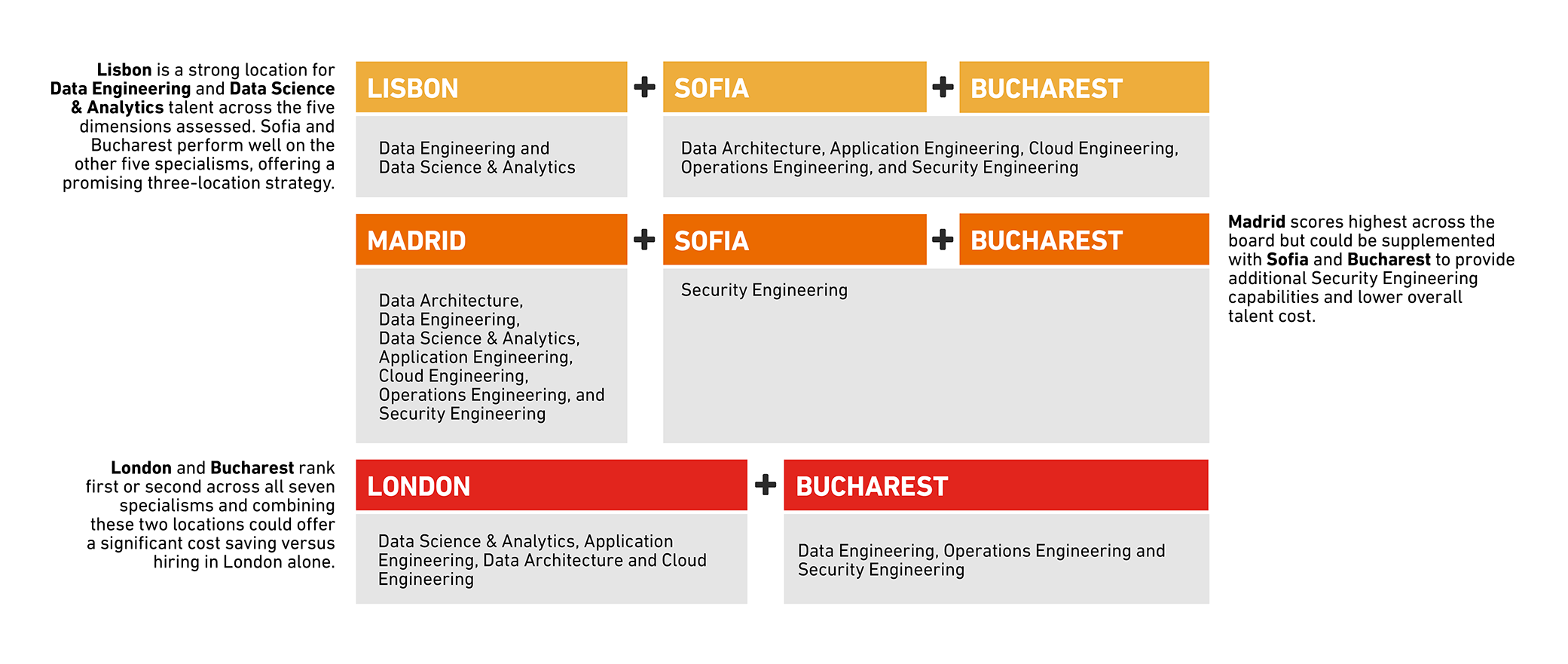

Multi-Location Strategies

Organisations looking to build the strongest teams at lower cost would be wise to consider hiring in different locations for specific tech specialisms. Below are three potential combinations which bring together the highest-ranking cities across different specialisms and provide cheaper talent overall.

Data in Depth

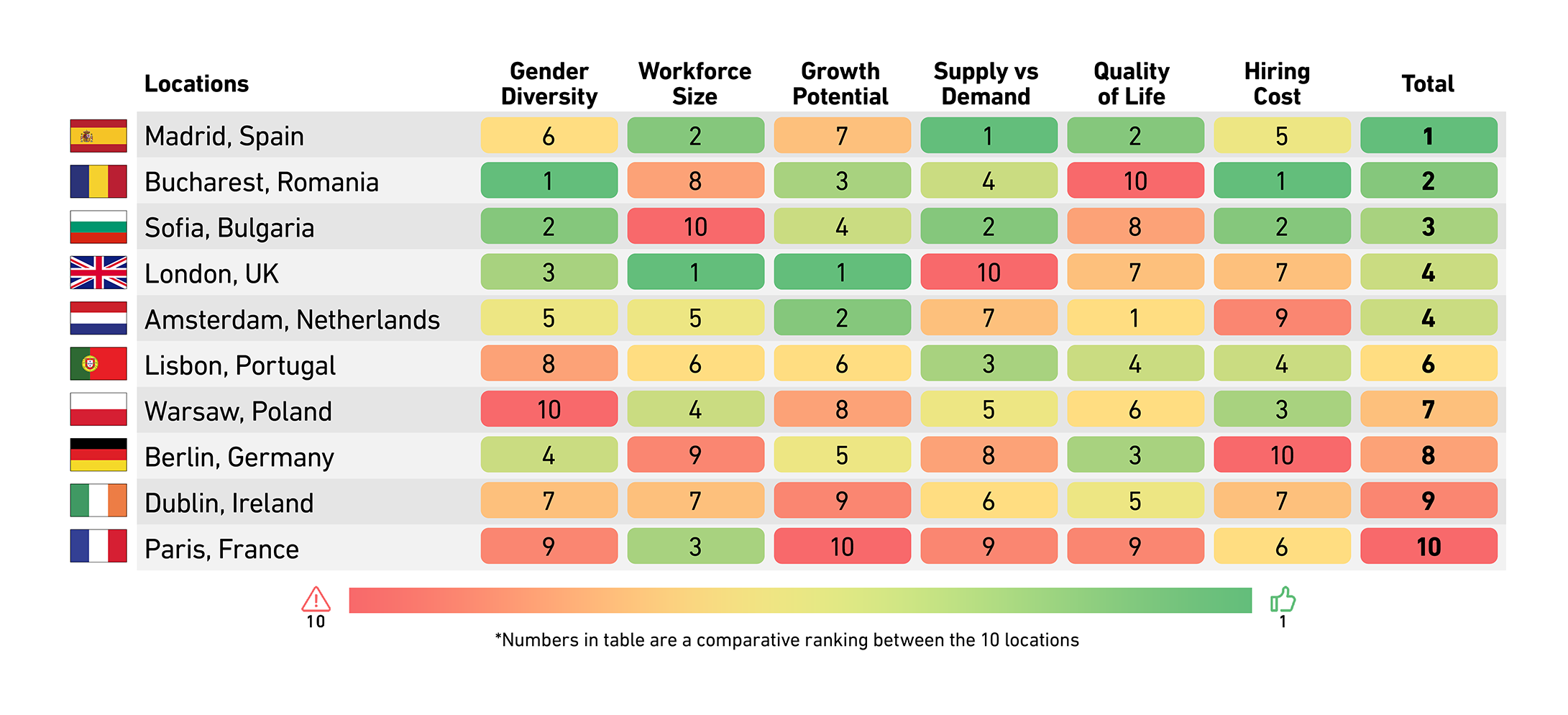

Figure 1: Full relative ranking analysis by location

This table shows the ranking of the 10 locations for each of the dimensions assessed and their overall ranking.

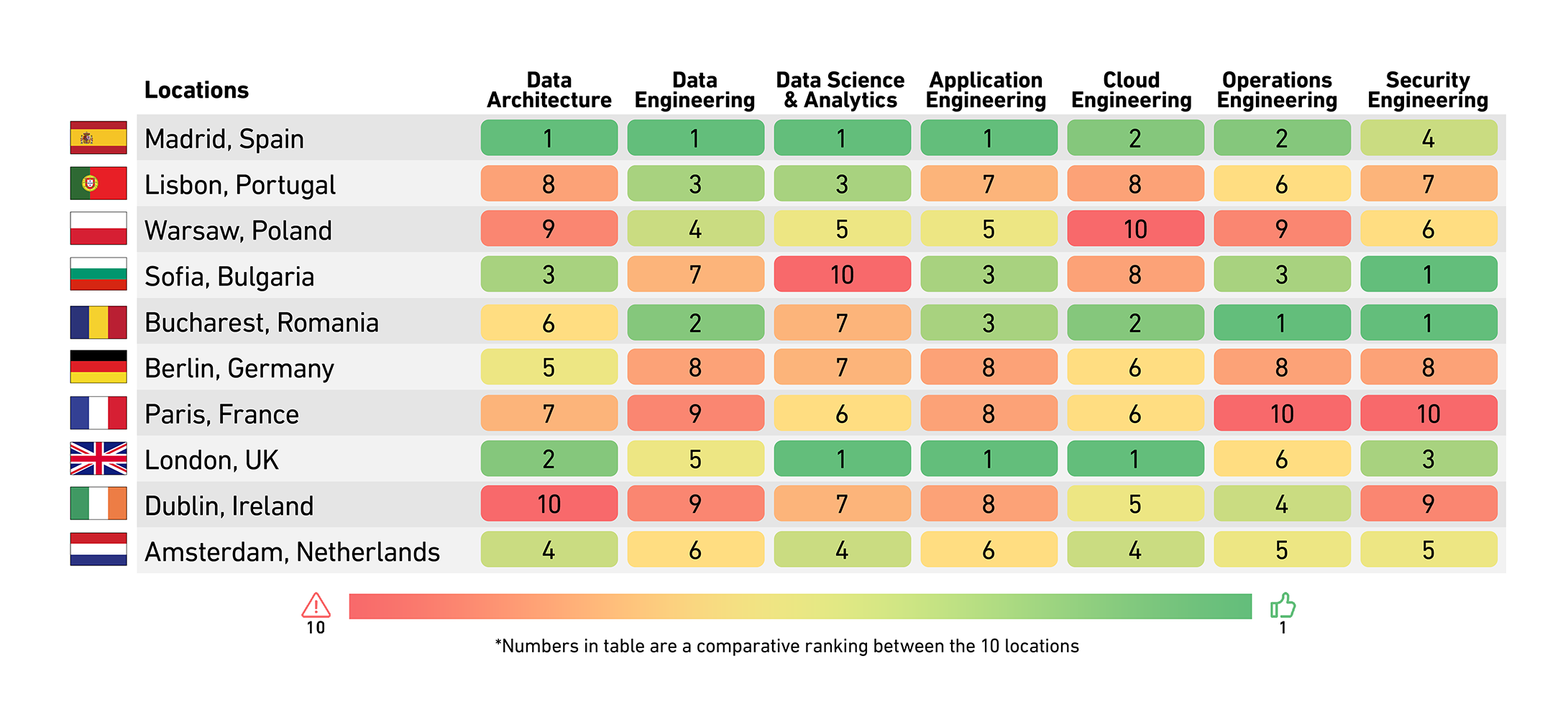

Figure 2: Full relative ranking analysis by specialism

This table shows the ranking of the cities for each technology specialism to consider, excluding cost, which are the most attractive locations for specific technology talent.

Figure 3: Compensation Comparison

Download full report here.