Download the full report here >

The Strategic Imperative of Financial Planning & Analysis Leadership

In today’s fast-evolving business landscape, Financial Planning and Analysis (FP&A) has become a cornerstone of strategic decision-making. As investor expectations rise, margins tighten, and real-time performance insights become critical, FP&A leaders are no longer purely operational. They are strategic advisors to CFOs, CEOs and cross-functional teams.

Yet the talent pool for these high-impact roles is shrinking. Only 6.5% of senior FP&A professionals have skills in automation and just 4% are proficient in predictive analytics, AI or data science. For CFOs, the question is clear: is your FP&A function equipped to meet the demands of a complex, data-driven future?

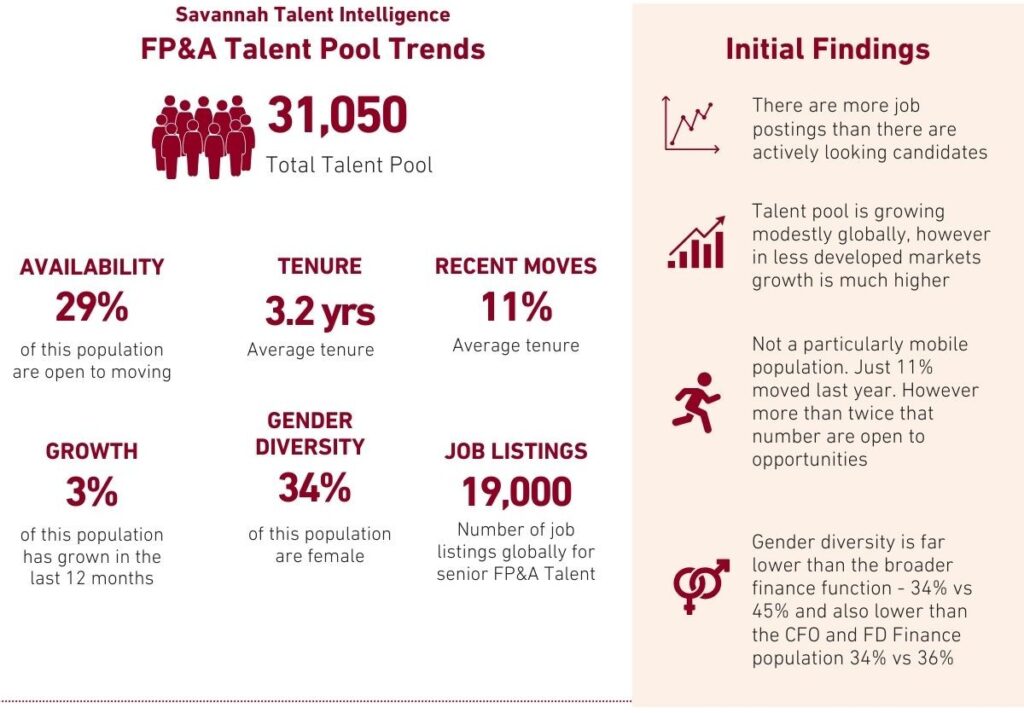

This white paper, based on Savannah’s Talent Intelligence analysis of over 31,000 global senior FP&A profiles, explores the evolving FP&A landscape, the critical talent shortage and actionable strategies to build future-ready teams. We outline how forward-thinking CFOs can address these challenges to drive measurable business outcomes.

The Evolving Role of FP&A Leadership

Over the past five years, FP&A has transformed from a reporting function to a strategic powerhouse. Today’s FP&A leaders must:

- Master strategic storytelling by translating data into compelling narratives to influence the C-suite and boardroom decisions.

- Collaborate across functions by partnering with operations, marketing and IT to align financial strategies with business goals.

- Drive innovation by embedding emerging skills such as automation, predictive analytics and AI into their teams.

Yet analysis of the talent pool reveals stark capability gaps:

- Less than 35% of professionals’ time is spent on high-value tasks such as generating insights and influencing the C-suite. The remainder is taken up by data validation and cleansing.

- Only 6.5% of senior FP&A professionals have experience in automation.

- Just 4% report expertise in predictive analytics, AI or data science.

These skills are critical as businesses invest in finance transformation and digital reporting infrastructure. Without them, FP&A teams risk falling behind in delivering strategic value.

What We Are Seeing in the Market and Why It Matters for FP&A Leadership

Savannah’s review of the global FP&A talent market highlights key trends shaping hiring and succession planning. Our recent analysis supports what many clients are already experiencing: the market for strategic finance talent is tight, complex and shaped by wider economic caution. While the data itself is not surprising, some important themes are emerging.

Caution is driving inertia, not a lack of interest

While 29% of FP&A leaders say they are open to new opportunities, actual movement remains limited. This is not due to a lack of ambition but rather a more cautious mindset across the market. Candidates are highly selective about potential moves and companies are equally cautious about hiring, often delaying decisions in search of a perfect fit.

Tenure is not the issue, but succession planning is

The average tenure of a senior FP&A leader is currently 3.2 years. In our experience, this is neither unusually short nor a cause for concern in itself. However, given FP&A’s increasingly strategic role, organisations cannot afford to lose momentum during transitions.

The challenge is not tenure but preparedness. Many businesses rely too heavily on a single individual at the top of the function. A stronger focus on succession planning and leadership development within the wider FP&A team is needed to ensure strategic continuity.

Gender diversity requires a sector-specific Lens

Our data highlights that 34% of senior FP&A professionals are women. On the surface, this appears reasonable, but in sectors such as financial services and other traditional industries, representation is often much lower. Female leadership in FP&A within these sectors is frequently closer to 20 to 25 per cent.

Unlike other areas of finance, gender diversity is rarely discussed in the context of FP&A. Yet as the function becomes more influential in strategic decision-making, addressing this gap could have a real impact. Improving diversity at this level is not only an inclusion issue but a business imperative.

This talent scarcity creates a significant challenge as organisations demand FP&A leaders who can turn data into actionable insights that shape strategic decisions.

How Forward-Thinking CFOs Are Responding

Leading CFOs are tackling the FP&A talent challenge with innovative strategies:

Broadening the search profile

CFOs are increasingly open to hiring senior FP&A leaders from outside their core industry, particularly from sectors with a more advanced approach to data, forecasting and decision support.

Technology, fintech and digital-native businesses are often ahead in their use of automation, scenario modelling and real-time dashboards. E-commerce and global consumer goods companies also bring strong experience in driver-based planning and commercial finance. Candidates from these environments are well-positioned to bring a more agile and insight-led approach to FP&A, something many traditional sectors are now striving to develop.

Internal development alone is not closing the gap

Many organisations are investing in upskilling their finance teams in areas such as automation, advanced analytics and AI-driven planning. While this is an important part of long-term capability building, it is not enough on its own, particularly when the business expects immediate strategic impact from FP&A.

In practice, we are seeing a growing need to bring in senior external talent who can lead this change from the front. These individuals not only bring technical credibility but also the commercial and leadership experience to elevate the function and embed new ways of working. They often play a critical role in mentoring internal teams, accelerating transformation and shaping the broader finance strategy.

Using talent intelligence for smarter hiring

By leveraging real-time talent market data, CFOs and Talent Acquisition teams can stress-test role requirements before launching searches, avoiding delays. Savannah’s Talent Intelligence platform, for example, helped a global manufacturer identify a candidate with rare AI skills within weeks.

Retention depends on impact, not perks

In a market where high-calibre FP&A talent is scarce and highly valued, retention is less about flexibility and more about creating roles where individuals can have real impact.

The strongest FP&A leaders are not looking for remote-first setups or light-touch involvement. They want to be close to the business, working side by side with commercial teams, influencing senior decision-makers and driving the financial narrative. They are motivated by ownership, visibility and the opportunity to shape outcomes.

Organisations that offer genuine strategic engagement, access to the C-suite and a clear mandate to lead change are far more likely to retain top FP&A talent than those focused solely on work-life balance or broad development pathways.

What This Means for CFOs: Benchmark, Rethink, Evolve

Best-in-class FP&A leaders have always brought strong technical foundations: robust modelling skills, analytical depth and financial discipline. But today, those capabilities are simply the starting point.

What sets the most effective leaders apart now is their ability to connect financial insight with strategic action. They are embedded in the business, shaping the narrative, challenging assumptions and influencing decisions at the most senior levels. They act as translators between data and direction, not just reporting the numbers but driving the story behind them.

At Savannah, we empower CFOs to stay ahead by:

- Benchmarking: comparing your FP&A function to global market and key competitor standards

- Hiring high-calibre talent: identifying leaders to drive growth, transformation, or provide succession

- Providing real-time insights: using our proprietary Talent Intelligence platform to map the availability of critical skills

Contact Savannah for a complimentary FP&A benchmarking assessment. https://savannah-group.com/contact-us/